After some light jousting with bears during yesterdays morning session the bulls reasserted themselves once again closing the SP-500 at new record highs. With the US/China trade uncertainty, rising tensions with Iran and a slew of company warnings about a difficult earnings season ahead the bulls continue to find the energy to push higher. The current trends are bullish and as of now the bears appear to have no teeth.

Asian markets closed lower across the board as trade worries continue to weigh heavily. European markets are higher the board with the nomination of Christine Lagard as the new head of the European Central Bank. US Futures are currently pointing to a modest gap up open ahead of busy Economic Calendar and an early market close at 1:00 PM Eastern. After the morning rush volume could drop significantly as trader’s head out early to celebrate the holiday.

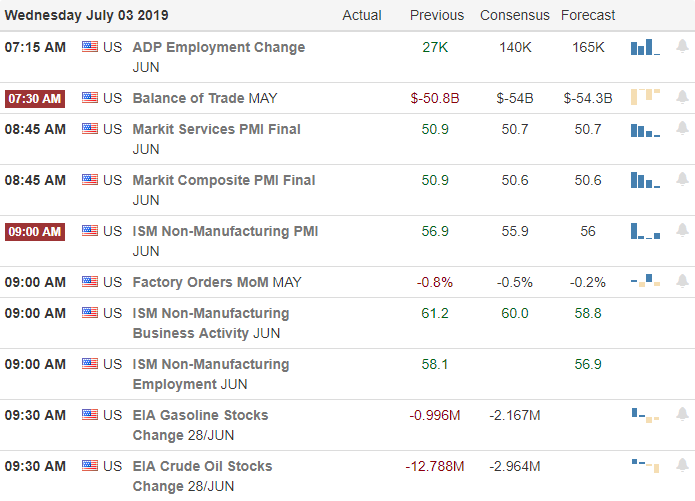

On the Calendar

On the Wednesday Earnings Calendar we have just two companies ISCA & OMN reporting today. They are not notable reports and unlikely to move the market.

Action Plan

We have a busy Economic Calendar this morning with ADP, International Trade, Jobless Claims, Factory Orders, ISM Non-Mfg & the EIA Petroleum Status. Although we could experience a morning flurry of activity with the markets closing at 1:00 PM Eastern, the volume could decline quickly creating anemic price action.

Yesterday’s price action saw choppy slightly bearish price action during the morning session but the Bulls refused to let that stand to stage an impressive comeback particularly in SP-500 that closed at another record high. Trends are still bullish although they appear to be a bit stretched however that is not stopping the bulls relentless push higher as the futures point to yet another gap up open this morning. I wish you all a safe and Happy 4th of July!

Trade Wisely,

Doug

Comments are closed.