The highly anticipated earnings from NVDA on Wednesday brought out the speculators surging the stock price that drove a Nasdaq rebound on Monday. However, the DIA and IWM struggled to find footing making for a choppy day even as the short-term oversold condition suggests a relief rally to at least test overhead resistance levels. With a bit more potential inspiration on the earnings and economic calendar perhaps the relief can continue to gain strength today but keep an eye on the rising bond yields that hint the Fed may not be done with rate increases.

Asian markets enjoyed a relief rally overnight shaking off the rising bond yields and worries over the Chinese economy. European markets look to extend the relief started yesterday with the tech sector leading the way. U.S. futures also point to a bullish open ahead of earnings and economic reports as bond yields push to levels not seen since 2007.

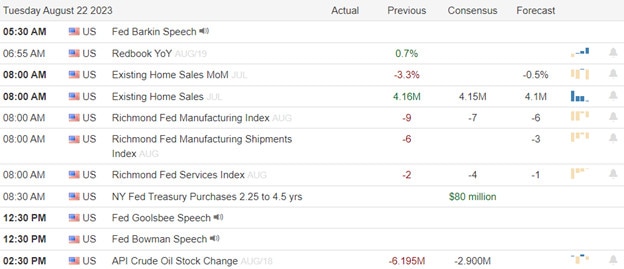

Economic Calendar

Earnings Calendar

Notable reports for Tuesday include BJ, SCIQ, COTY, DKS, LZB, LOW, M, MDT, TOL, and URBN.

News & Technicals’

The U.S. banking sector is facing increased pressure from the global rating agency S&P Global, which downgraded the credit ratings and outlooks of several major banks on Monday. The agency cited the challenges posed by the ongoing pandemic, low-interest rates, and heightened competition as the main factors that could erode the banks’ profitability and credit quality. S&P Global followed the footsteps of Moody’s, which also lowered its ratings and outlooks for some U.S. banks last week. Both agencies warned that the banks could face higher funding costs and lower earnings in the near future.

Lowe’s announced its second-quarter results, showing a solid performance amid the high demand for home improvement products and services. The company reported a net income of $3.02 billion, or $4.25 per share, up from $2.83 billion, or $3.74 per share, a year earlier. This beat the consensus estimate of $4.01 per share. However, the company’s revenue fell slightly short of expectations, as it recorded total sales of $27.57 billion, compared to the forecast of $27.75 billion. Lowe’s attributed the revenue miss to the supply chain disruptions and labor shortages that affected its ability to meet customer demand. Despite the challenges, the company reaffirmed its full-year guidance, expecting a sales growth of 4.5% and an operating margin of 12.2%.

Zoom continued to enjoy strong growth in the second quarter, as more people and businesses relied on its services for remote work and communication. The company reported a revenue of $1.02 billion, up 54% year-over-year, and surpassing the analysts’ estimate of $991 million. The company also posted a net income of $317 million, or $1.08 per share, compared to $186 million, or $0.63 per share, a year ago. This exceeded the consensus forecast of $0.99 per share. Zoom also raised its full-year guidance, expecting revenue of $4.01 billion to $4.02 billion, and earnings per share of $4.75 to $4.79. Zoom also introduced a new feature that allows customers to start free trials for automated meeting summaries without recording calls, enhancing its product offerings and customer experience.

The S&P 500 and the Nasdaq rebounded from a three-week slump, led by a surge in NVDA heading into its highly anticipated earnings report on Wednesday. European stocks also rose, while Asian markets were mixed amid ongoing worries about China. Government bond yields climbed to multiyear highs ahead of the Fed’s annual Jackson Hole meeting. The 10-year Treasury yield reached 4.33%, the highest since 2007, and the 30-year yield hit 4.45%, the highest since 2011 putting more pressure on the banking sector and consumers. Today we face reports on Existing Home Sales, Richmond Fed Mfg. along with a couple of Fed speakers. We also have several notable earnings reports for the bulls or bears to find inspiration with a retail theme. Plan for volatility to continue with higher rates worries about the Chinese economy and banking downgrades.

Trade Wisely,

Doug

Comments are closed.