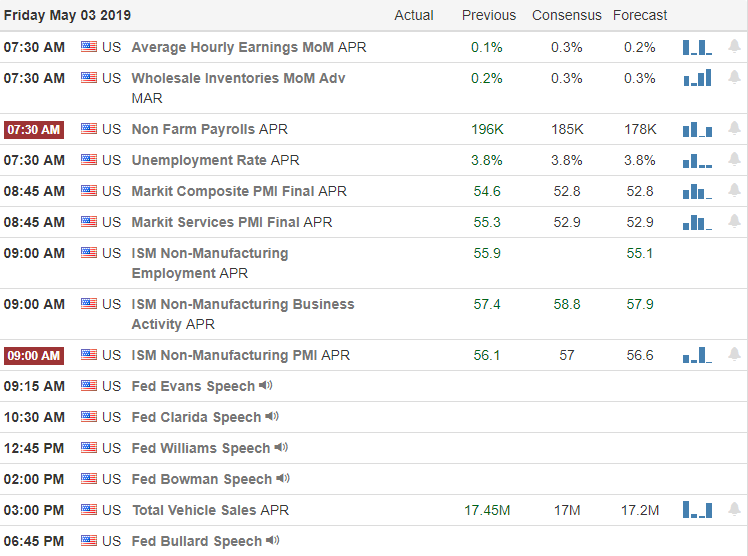

This morning is all about the May Jobs Report that will be out at 8:30 AM Eastern. Consensus expects a strong report of growth and an unemployment number near historic lows. Consequently the futures are pointing to nice bullish open ahead of the report but of course how the market opens will depend upon the actual results.

Perhaps the number will lift the market out of its 2-day funk and the index once again reach out for new record highs. Only time will tell so stay focused on price action and avoid predicting or getting caught up in the fear of missing out chasing a morning gap into all-time high resistance. Thankfully we have a little break on the earnings calendar today but keep in mind next week is another huge week of reports so plan your risk into the weekend carefully.

On the Calendar

We have a little break on the Earnings Calendar today less than 75 companies reporting. Among the notable reports are D, FCAU, FRAM, SNR, NWL, NBL, TRP & WPC.

Action Plan

Futures are higher this morning ahead of the May Jobs Report with the exception of strong employment growth and an unemployment number near historic lows. Perhaps this is just the catalyst we need to get the market out the funk it has been in the last couple days. We will once again have to be watchful and respect the new resistance levels that recently created. A gap up into all-time resistance could easily set up a pop and drop so be careful chasing with the fear of missing out.

The market has done a good job of ignoring the political drama being played out in Washington thus far but as this drama escalates anything is possible. We have another massive week on earning reports next week so plan your risk carefully as we head into the weekend. Have a great weekend everyone!

Trade Wisely,

Doug

Comments are closed.