With a massive short squeeze, the bulls managed not only managed set new records but chose to ignore the possible outbreak impacts. With the virus now spread to more than 28,000 and the possibility China will have to extend business closures, it will be interesting to see what comes next. The President acquitted Chinese tariff cuts, and a huge day of earnings and economic reports would suggest price volatility continues and that anything is possible.

Asian markets rally to close green across the board in reaction to the Chinese tariff cuts overnight. European markets are also in rally mode this morning with gains across all indexes. US Futures point to more new record highs with Dow once again set to gap up more than 100 points at the open. Once again, be very careful chasing the open. Plan your trading carefully.

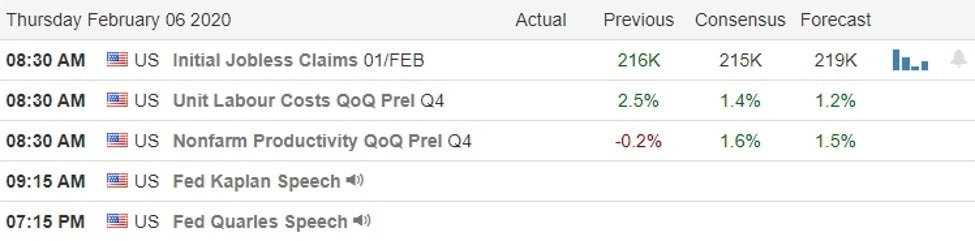

On the Calendar

On the Thursday earnings calendar, we have our biggest day this week, with more than 210 companies reporting. Notable reports include UBER, ATVI, MT, BIDU, BLL, BDX, BMY, CAH, DNKN, EL, EXPO, FCAU, FTNT, HBI, IQ, K, MPW, NYT, NLOK, PENN, PM, PINS, SPGI, SNY, SKX, TTWO, TPR, TMUS, TWTR, TSN, WWE, WYNN, XYL, & YUM.

Action Plan

A soaring day in the market as bulls stage a relentless push once again breaking records. After the bell, the Senate voted to acquit the President of all charges and this distraction is now in the rearview. During the night, China announced it would cut tariffs on hundreds of US goods by half a gesture they say is an attempt to improve the trade relations between the two countries. Numbers on the Coronavirus continue to grow rapidly with now more than 28,000 confirmed cases and 563 deaths. Japan reported ten more people on the quarantined cruise ship have tested positive bring the total to 20 cases. Over the last 3-days, the market has done a good job of ignoring the potential economic impacts of the outbreak; one has to wonder how much longer that can continue.

Tariff cuts, earnings and economic reports will provide plenty of opportunities for price volatility to continue today. The T2122 indicator went from oversold or overbought in just 3-days of trading, indicating just how emotionally charged and volatile price action has become. After such a strong run, it might be wise to consider taking some profits rather than chasing stocks that appear very extended or pushed up against resistance levels. Futures this morning are once again pointing to a gap up open, and it’s very easy to feel the fear of missing out and find yourself wanting to chase. Consider your risks carefully as the bulls continue to stretch stocks far from support levels.

Trade Wisely,

Doug

Comments are closed.