Markets ignore impeachment of the President and power higher once again, setting new record highs. Santa Claus has done well this year! Now the question on trader’s minds is, can this rally continue right into the weekend or will there be some profit-taking as trade reduce risk ahead of the holiday. With a light earnings calendar, the market will likely look to the big reports on the economic calendar for inspiration. As of now, the bulls are solidly in control of the bullish trends, and the bears seem to no willingness to fight back as the VIX continues to decline.

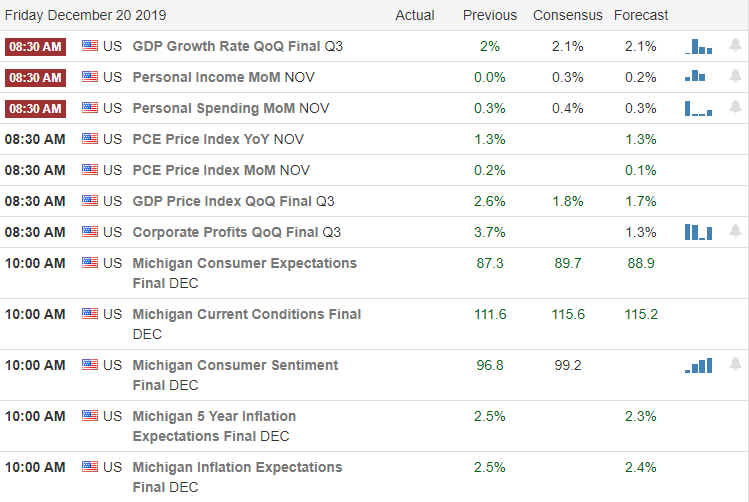

Overnight Asian markets closed the week mostly lower as Japan’s automakers fall after the US House passed the North American trade agreement. European markets see only green this morning as the rally continues after the Phase 1 trade deal lifted spirits. Here in the US, the Futures currently point to a flat slightly bullishly leaning open ahead of GDP, Personal Income and Outlays, & Consumer Sentiment reports.

On the Calendar

On the Friday Earnings Calendar, we have just 14 companies fessing up to their results. Notable reports, BB, CCL, & KMX.

Action Plan

Markets defied the Presidential impeachment by the House rallying to new record highs confident that the Senate will respond with an acquittal. With the mid-week holidays just around the corner, Santa has delivered the market a very nice rally without the wild volatility. Perhaps this bullishness can continue right on through the new year, but being a little more conservative, I’m likely to go to the bank today, lowering my risk into the weekend. Don’t get me wrong; there is nothing in the charts at this point that suggests bearishness but anything can happen over the weekend and I’m happy with a bird in the hand.

With a relatively light day on the earnings calendar, I would expect the market to look to the economic reports of GDP, Personal Income and Outlays, & Consumer Sentiment to find inspiration today. Consensus estimates suggest the reports will remain strong so a surprise reading could upset the apple cart, so as always, stay focused on price action for clues. If you’re traveling this weekend to join family and friends to celebrate Christmas, I wish you all safe travels and a Very Merry Christmas!

Trade Wisely,

Doug

Comments are closed.