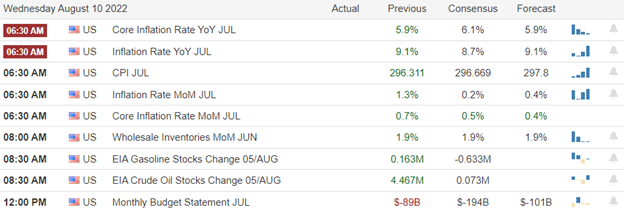

A low volume sideways chop won the day after an energic early rally that eventually found some cautions sellers likely considering the ramifications of the pending inflation data. Unfortunately, with the CPI on Wednesday morning, we still have another day to hurry up and wait, with the future direction of the indexes on the line. With the indexes tucked tightly against resistance, the stage is set for a possible significant move, but the direction is anyone’s guess. So, consider the risk and plan carefully as we head into the close of the day.

Asian markets traded mixed overnight with a 7% drop in SoftBank with the Nikkei leading the declines. European markets traded in the red across the board this morning focused on U.S. inflation and the outlook of the FOMC. Ahead of a busy earnings day, U.S. futures reversed early gains pointing to a flat open with the uncertainty of the CPI data looming. Watch for intraday whipsaws as prices chop while we wait on data that could secure or disrupt the relief rally in the blink of an eye.

Economic Calendar

Earnings Calendar

We ramp up the number of earnings today with over 250 companies listed with a large group unconfirmed. Notable reports include AKAM, ARMK, ARWR, BHC, BE, COIN, CPRI, CG, CRON, DIN, EBIX, EMR, GFS, GO, HRB, HGV, H, IAC, IRBT, MAXR, NCLH, PRGO, PLNT, RXT, RL, RBLX, SAVE, SMCI, SYY, TTD, TTEC, U, WMG, WWE, & WYNN.

News & Technicals’

Spirit Airlines reported a second-quarter loss after costs surged despite a jump in revenue. The airline agreed to sell itself to JetBlue for $3.8 billion late last month. Spirit executives are scheduled to discuss results with analysts on Wednesday morning. Trump said that the FBI raided Mar-a-Lago, former President Donald Trump’s resort home in Palm Beach, Florida. In a lengthy statement, Trump said his residence was “currently under siege, raided, and occupied by a large group of FBI agents.” The raid came after months of questions about whether Attorney General Merrick Garland was planning to pursue investigations into the former president. Novavax cut its 2022 sales outlook by about 50% and now expects to generate $2 billion to $2.3 billion in revenue. Novavax previously forecasts $4 billion to $5 billion in revenue. CEO Stanley Erck said Novavax expects no new sales in the U.S. market or from Covax, an international vaccine alliance, in 2022. Ezra Miller, who portrays Barry Allen, aka the Flash, as part of the DC Extended Universe, has been charged with felony burglary in Stamford, VT. The felony burglary charge against Miller comes almost a year before Warner Bros. is slated to release “The Flash,” a $100 million film that is part of the studio’s DC franchise. The news comes just days after Warner Bros. Discovery’s CEO praised the film during an earnings call. Bed Bath & Beyond and AMC Entertainment surged as meme traders were betting on the stock despite the lack of apparent catalyst. The heavily shorted stocks have been a part of the meme stock craze that has recently hit Wall Street. Allbirds cut its financial forecast for the year, citing a slowdown in consumer spending. The sustainable shoemaker said it was slowing hiring as part of its efforts to cut costs. For the second quarter ended June 30, Allbirds said its revenue rose 15% from a year ago. The U.S. Treasury’s blacklisting of Tornado Cash on Monday will do more than take down criminals. Many ordinary crypto investors are likely to be hurt, experts say. Treasury yields ticked higher in early Tuesday trading, with the 2-year at 3.22%, the 5-year at 2.94%, the 10-year at 2.79%, and the 30-year at 2.88%. Most surprisingly, the 12-month are currently inverted over the 2,5,10, and 30-year bonds, trading at 3.26%.

Yesterday’s early pop in the indexes met with caution, bringing in some sellers at price resistance and spending the rest of the day in a low volume sideways chop. However, no technical damage occurred, and the bulls remained in control of the relief rally despite the low volume and loss of momentum. Earnings continue to come in mixed, and the bond yields rise as the market waits in anticipation of the CPI and PPI inflation data. I would not rule out another day of choppy price action while waiting for the data. Speculation is high as meme stocks rose sharply yesterday without an apparent catalyst illustrating the high emotion around the recent run. There is a chance we are building up for a big move. Your guess in direction is as good as mine, so plan your risk carefully!

Trade Wisely,

Doug

Comments are closed.