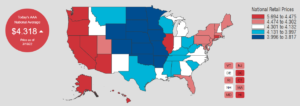

Although it was nice to get a relief rally yesterday, the low-volume move was likely more short covering than actual buying. Sadly, the big point rally did little to nothing in repairing the technical damage in the index charts. So today, we will turn our attention back to the rising inflation and the ugly impacts for the consumers as the national average price of gasoline rises to $4.31, up from $4.17 just one day ago. Plan for some wild price volatility as traders react to the CPI number revealed before the bell.

Asian markets followed the U.S. markets with a sharp overnight rally, with the Nikkei leading the way, rising 3.94%. Unfortunately, the relief rally may be short-lived, with European markets decidedly bearish this morning. U.S. futures also point to a nasty gap down as we wait on the CPI numbers.

Economic Calendar

Earnings Calendar

We have more than 250 companies listed on the Thursday earnings calendar, but a large number of them are unconfirmed. Notable reports include ORCL, RIVN, ACRX, BZUN, BLNK, DLTH, LOCO, AG, GCO, HGBL, JD, LZ, MLNK, NEON, PSTL, RRGB, TLYS, UTLA WPM, & ZUMZ.

News & Technicals’

Russia – Ukraine fails to reach a cease-fire deal, sending U.S. futures lower and Wednesday’s substantial gains. Brent crude futures were up $3.10, or 2.8%, at $114.24 a barrel at 0419 GMT after trading in a more than $5 range. In nearly two years, the benchmark contract slumped 13% in the previous session in its biggest one-day drop. U.S. West Texas Intermediate (WTI) crude futures were up $1.58, or 1.5%, at $110.28 a barrel, after trading in a more than $4 range. The contract had tumbled 12.5% in the most significant daily decline in the previous session since November. On Thursday, Bitcoin and other cryptocurrencies fell as some of the initial excitement around U.S. President Joe Biden’s executive order on digital assets faded. Bitcoin was down more than 6% at $39,086 at 3:38 a.m. ET on Thursday, according to data from CoinDesk. Some high-profile cryptocurrency industry players praised the president’s executive order, while others called the move “defensive.” Amazon’s 20-to-1 split makes it more palatable to the price-weighted Dow Industrials. Perhaps the Dow index committee may consider giving Walgreens the boot from the index as that company reevaluates its Boots unit. On top of Amazon and Alphabet, which had its 20-to-1 split back in February, Nvidia could also be waiting in the wings. According to Dow Jones, economists expect consumer inflation will hit a new 40-year high of 7.8%. The consumer price index is the last big inflation release before the Federal Reserve meets next Tuesday and Wednesday. CPI was expected to peak in March, but now economists say it could do so later in the spring, depending on what happens with oil prices. Treasury yields declined slightly in early Thursday trading, with the 10-year slightly lower at 1.9270% and the 30-year dipping to 2.3022%.

With a sizeable overnight gap and a low-volume move, the indexes managed to trigger a short-covering squeeze pushing the indexes up to test overhead resistance. Although the rally relieved the recient selling pressure, it, unfortunately, did nothing to improve the overall bearish technical picture of the indexes. Helping the rally was the commodity selling, but I fear that will be very short-lived with the pending CPI number before the bell today. Though bent crude declined, the average national price of gasoline moved higher to $4.31 a gallon. Some areas of California are approaching $8.00 a gallon while diesel prices around the county top $5.00 a gallon. The rapidly rising prices create long lines at stations as consumers rush to fill their tanks before the subsequent price increase. So buckle up for another round of volatility as the market comes to grip with the rising inflation and the massive impacts to the consumer.

Trade Wisely,

Doug

Comments are closed.