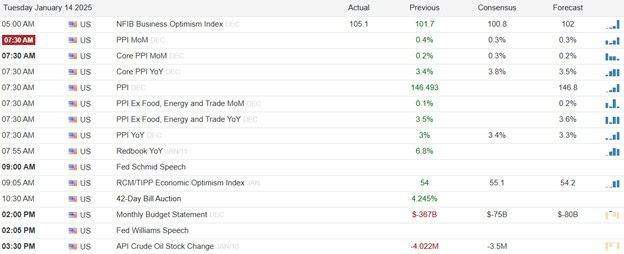

US Stock futures rose as investors prepared for the first of two, key inflation reports this week. The producer price index (PPI), which tracks wholesale inflation, is scheduled for release at 8:30 a.m. ET. Economists surveyed by Dow Jones expect the headline PPI to have increased by 0.4%, with the core PPI, excluding food and energy, anticipated to rise by 0.3%. In the earnings arena, major banks are set to kick off the fourth-quarter earnings season. JPMorgan Chase, Citigroup, Goldman Sachs, and Wells Fargo will report their results on Wednesday, followed by Morgan Stanley and Bank of America on Thursday.

European markets traded higher, reversing the recent negative sentiment in the region. However, investors remain cautious, closely monitoring borrowing costs for core European economies as bond yields stay elevated. The oil and gas sectors led the losses, declining by 0.7% after BP announced that its fourth-quarter profit would be impacted by up to $300 million due to weakening refinery margins. Retail stocks also faced challenges, with JD Sports plummeting to the bottom of the Stoxx 600 after lowering its profit guidance.

Asia-Pacific markets experienced a general upward trend, with notable gains in several key indices. Hong Kong’s Hang Seng index surged by 1.9%, and mainland China’s CSI 300 saw an impressive rise of 2.63%. In contrast, Japan’s markets were the exception, as the Nikkei 225 fell by 1.83% and the Topix decreased by 1.16%. South Korea’s Kospi closed with a modest increase of 0.31%, while the small-cap Kosdaq performed better, adding 1.39%. Australia’s S&P/ASX 200 also ended the day positively, up by 0.48%. Meanwhile, investors are keeping a close eye on India’s rupee, which has weakened to a record low against the U.S. dollar.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include PGR. After the bell reports include APLD, & CVGW.

News & Technicals’

According to a report by Bloomberg News on Monday, the Chinese government is considering a plan for Elon Musk to acquire TikTok’s U.S. operations to prevent the app from being effectively banned. This contingency plan is one of several options China is exploring as the U.S. Supreme Court deliberates on whether to uphold a law requiring ByteDance, TikTok’s China-based parent company, to divest its U.S. business by January 19. If the deadline passes without compliance, third-party Internet service providers would face penalties for supporting TikTok’s operations in the U.S. Under the proposed plan, Musk would manage both X, which he currently owns, and TikTok’s U.S. business. However, Chinese officials have not yet made a final decision on whether to proceed with this plan.

Two Robinhood broker-dealers, Robinhood Securities LLC and Robinhood Financial LLC, have agreed to pay a combined $45 million in penalties to settle administrative charges by the Securities and Exchange Commission (SEC). The SEC found that the firms violated over ten securities law provisions related to their brokerage operations. These violations included failing to report suspicious trading promptly, not implementing adequate identity theft protections, and inadequately addressing unauthorized access to their computer systems. Additionally, Robinhood Securities was cited for failing to provide complete and accurate securities trading information, known as blue sheet data, to the SEC for more than five years.

A global sell-off in bond markets is intensifying, raising concerns about government finances and the potential for higher borrowing costs for consumers and businesses worldwide. Bond yields have been climbing globally, with the U.S. 10-year Treasury yield reaching a new 14-month high of 4.799% on Monday. In the UK, 30-year gilt yields are at their highest since 1998, and the 10-year yield has hit levels not seen since 2008. Japan, which has been working to normalize its monetary policy after ending its negative interest rates regime last year, saw its 10-year government bond yield rise above 1%, the highest in 13 years, on Tuesday. In the Asia-Pacific region, India’s 10-year bond yields rose the most in over a month on Monday, nearing two-month highs at 6.846%. Similarly, yields on New Zealand and Australia’s 10-year benchmark government bonds are also near two-month highs. Meanwhile, China’s 10-year bond yield dropped to a record low this month, leading the central bank to suspend its government bond purchases last Friday.

On Tuesday, Los Angeles firefighters prepared for intense winds that could exacerbate two massive wildfires, which have already claimed two dozen lives, destroyed entire neighborhoods, and burned an area equivalent to the size of Washington, D.C. Meteorologist David Roth from the National Weather Service’s Weather Prediction Center warned of potential hurricane-force winds reaching 75 mph (120 kph) from early Tuesday, with gusts between 50-70 mph expected through Wednesday. Over 8,500 firefighters battled the blazes from both the air and ground, successfully preventing the fires from spreading overnight. Los Angeles City Fire Chief Kristin Crowley cautioned residents, stating, “This setup is about as bad as it gets. We are not in the clear.”

With the beginning of earnings season tomorrow and the combined influence of the key inflation reports, PPI today and CPI plan for significant price volatility. Today also keep a close eye on the bond yields as they provide some strong clues to overall market direction.

Trade Wisely,

Doug

Comments are closed.