Rising joblessness due to growing pandemic pressures and increasing tensions between the US and China had bears asserting themselves yesterday afternoon. Intraday charts indicate a little caution may be in order as we head into the uncertainty of the weekend, but as of now, the daily bullish index trends remain intact. With another big government stimulus plan on the way, it may be difficult for the bears to follow-though on yesterday’s selling. I would not expect the bulls to give up easily as they bask in the glow of newly printed money.

Asian markets saw red across the board during the night as rising US/China tensions weigh on investors. European markets are also in the red this morning after China orders the closing of a US consulate in retaliation. US Futures currently point to modest declines as we wait on new home sales data and earnings. Expect price volatility to remain high as we head into the uncertainty of the weekend.

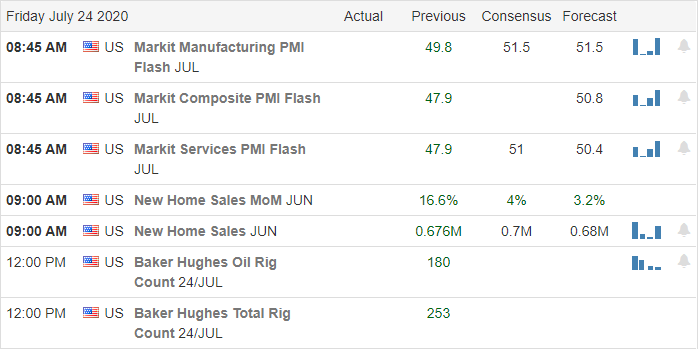

Economic Calendar

Earnings Calendar

On the Friday, we have 45 companies set to report quarterly results. Notable reports include AXP, BLMN, HON, NEE, NEP, SLB, & VZ.

News and Technical’s

The market had to deal with the prospect that the pandemic is having severe impacts on national joblessness. There are nearly 30 million Americans unemployed far more than the worst of the 2008 financial crisis. The US has now reached another grim record topping 4 million infections, and yesterday, Florida record a record daily death toll. Yesterday, the President suggested that some schools may have to delay reopening and also canceled parts of the upcoming GOP convention. If that were not enough uncertainty for the market to deal with China last night made its retaliatory move in the dangerous game with the US. China has now ordered the US to close the consulate in Chengdu. In a fiery speech, Secretary of State Mike Pompeo’s slammed the Chinese government for its actions while attempting to rally the Chinese people against the Communist Party. According to reports, the Senate expects to unveil its coronavirus relief pan next week, adding yet another wrinkle for the market to grapple with heading into an uncertain weekend.

Although we did see some significant selling yesterday afternoon, the daily technicals of the index charts remain bullish, with the short-term uptrends still intact. The big question for today is, with the mounting economic pressures of the pandemic can the bulls find the energy to defend price supports heading into the weekend. Keep an eye on the tech giants that have led this historic market rally. Should they begin to experience some profit-taking, it may be tough for the indexes to maintain current trends.

Trade Wisely,

Doug

Comments are closed.