Tech stocks spearhead a rise in US equity futures as traders anticipated comments from Federal Reserve Chair Jerome Powell for insights into future interest rate movements. The Nasdaq 100 index contracts saw a 0.7% increase, driven by favorable earnings reports within the tech sector. Meanwhile, S&P 500 contracts also moved up, following the benchmark’s achievement of its 55th record high for the year on Tuesday. Additionally, the dollar gained strength, and 10-year Treasury yields rose, reflecting broader market dynamics.

European stocks were on the rise early Wednesday as investors prepared for a no-confidence vote in France’s National Assembly. The French CAC 40 index increased by 0.4% in morning trading, reflecting cautious optimism amid a politically turbulent week in France. The autos sector led the gains, climbing 1.2% following a report from Italian newspaper Corriere della Sera that Stellantis is considering outgoing Apple CFO Luca Maestri for its CEO position. Conversely, stocks in the healthcare, food and beverage, and basic resources sectors were trading lower.

South Korean markets experienced a significant downturn on Wednesday as political pressure intensified on President Yoon Suk Yeol following his brief imposition and subsequent lifting of a martial law decree. Concerns over financial instability prompted the Bank of Korea to announce plans to enhance short-term liquidity and implement measures to stabilize the foreign exchange market as needed. The Kospi index declined by 1.44%, and the Kosdaq fell by 1.98%. In contrast, Japan’s Nikkei 225 remained nearly flat, while Mainland China’s CSI 300 and Australia’s S&P/ASX 200 saw modest declines of 0.54% and 0.38%, respectively.

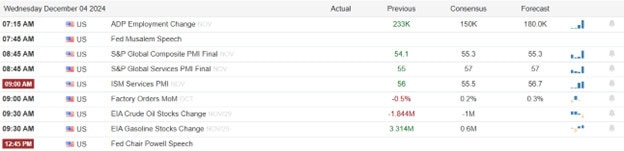

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include CPB, CHWY, DLTR, FL, HRL, RY, & THO. After the bell reports include AVAV, AEO, CHPT, DSGX, FIVE, GEF, NCNO, PVH, S, CXM, SNPS, & VRNT.

News & Technicals’

Attention Wednesday will be focused on Powell’s upcoming speech and the latest US data on services and manufacturing as the market anticipates Friday’s crucial labor market update. Fed Bank of San Francisco President Mary Daly mentioned that while a December rate reduction isn’t guaranteed, it remains a possibility. Guy Miller, chief strategist at Zurich Insurance, noted that the Fed has been clear in its signaling so far, suggesting that if a pause is considered, Powell might hint at it to avoid surprising the market. This comes amid a significant surge in US stocks, with the S&P 500 index climbing 27% this year.

French markets remained relatively stable ahead of Wednesday’s no-confidence vote, which poses a threat to the current government. The CAC 40 index saw a slight rise, marginally outperforming the broader European Stoxx 600 index. Meanwhile, the yield premium on French bonds compared to their German counterparts held steady, and the euro experienced a slight weakening. This stability in the markets was anticipated by Nannette Hechler-Fayd’herbe, EMEA chief investment officer at Lombard Odier.

Investors in South Korea are closely evaluating the future political landscape after the opposition Democratic Party announced plans to pursue treason and impeachment charges against President Yoon for his illegal declaration of martial law. In response to the potential instability, the Bank of Korea has committed to boosting short-term liquidity and taking proactive measures in the currency markets to maintain stability. Charu Chanana, chief investment strategist at Saxo Markets, noted that while some uncertainty remains, the swift actions by Korean authorities could help limit the regional impact.

U.S. airline executives are preparing to defend their seating fees before a Senate panel on Wednesday, following accusations from the subcommittee that the industry has been generating billions in revenue through “junk” fees. The Biden administration, along with some lawmakers, has vowed to address these fees, specifically targeting the airline industry for reductions. According to a report released on November 26 by the Senate Permanent Subcommittee on Investigations, American, Delta, United, Spirit, and Frontier airlines collectively amassed $12.4 billion in seating fees from 2018 to 2023.

The bulls are running hard this morning but keep in mind Jerome Powell speaks this afternoon, and anything is possible. Bank of America published a report to their customers to exercise caution as you head toward the Friday jobs report suggesting the market may be getting ahead of itself considering the pending government shutdown on the 20th and big shakeup expected as the new administration takes control. Of course, stay with the trend but watchful for a change as the market continues to wildly extend.

Trade Wisely,

Doug

Comments are closed.