After setting new records on Friday, we look to have mixed open as we wait for a vote in the Senate on the trillion-dollar infrastructure bill. Volume on Friday was below average, and the absolute breadth index decline to recent lows, but the VIX indicated declining fear falling below its 50-day average. With another busy week of earnings and a CPI reading on Wednesday, the recent price volatility will likely stick around, so plan your risk carefully. Though the IWM remains weak, the trends in the DIA, SPY, and QQQ are very bullish. So stay with the trend but have a plan should the bears decide to attack due to the lofty valuations.

Asian market kicked off the week with modest gains as oil prices fell 3%. European markets trade primarily in the red this morning, keeping an eye on earnings results. With more than 200 companies reporting and a JOLTS report later this morning, the U.S. futures suggest a mixed open with the Dow in retreat and the Nasdaq pointing to modest gains. Let the wild earnings rollercoaster ride continue!

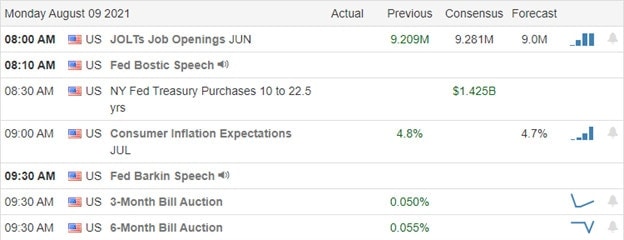

Economic Calendar

Earnings Calendar

Although the bulk of market-moving reports are behind us, we still have a busy week of reports with more than 200 listed on the calendar. DDD, PLNT, APD, AMC, GOLD, BNTX, CBT, ELY, CF, CHGG, CXW, APPS, DISH, EBIX, ELAN, ENR, GLNG, KNDI, QLYS, SGMS, SDC, TTD, TSN, & WKHS.

News & Technicals’

According to reports, the Senate is inching closer to passing the trillion-dollar infrastructure bill. Debate is now closed, and there is the hopefulness that a vote is forthcoming. With more hyped-up deals turning into flops, lawsuits against the once-popular SPAC are running into suspect dealmaking questions. On Sunday, Larry Brilliant, a famed epidemiologist, said that the world is nowhere near the end of the pandemic, with only a small proportion of the world’s population vaccinated. He suggested that vaccinated people aged 65 with a weakened immune system should get a booster shot right away. If that’s not gloomy enough, a U.K. report delivered a stark warning on climate change, calling it a code red for humanity. Treasury yields start the week higher, with the 10-year trading up to 1.292% and 30-year rising to 1.942%

After gapping higher and setting new records in the DIA & SPY, the market mostly chopped the rest of the day as if most traders left for an early weekend after the jobs report. As a result, volume came in lower than average, and the Absolute Breadth Index fell to recent lows to close the week. However, on a positive note, the VIX finally broke down below its 50-day average. The bulls remain in control with positive trends in the DIA, SPY, and QQQ, with the IWM remaining the outlier still below its 50-day average. Though we’re over the hump with market-moving reports, we still have a busy week of earnings to keep the price volatility high. That said, stay with the trend but have a plan to protect your capital should the bears find a reason to attack. From these loft valuations, any pullback could be swift and painful.

Trade Wisely,

Doug

Comments are closed.