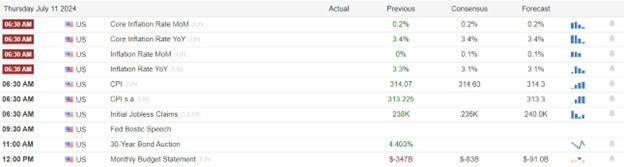

U.S. stock futures edged slightly lower early Thursday, with a cautious stance as traders as braced for the inflation report. The high anticipation centers around the June consumer price index and the ramifications it will have on future interest rate decisions. Economists polled by Dow Jones have set their expectations for a modest increase of 0.1% month-over-month. On an annual basis, the CPI is projected to rise by 3.1% compared to the same period last year.

European markets rallied Thursday morning, with indices across the region climbing as investors anticipate the forthcoming U.S. inflation data. The upbeat mood was bolstered by flash figures indicating that the U.K. economy expanded by 0.4% in May, a welcome recovery following a stagnant April and surpassing the modest 0.2% growth anticipated by analysts. This economic uptick was mirrored in the currency market, where the British pound appreciated by 0.21%, reaching its highest valuation against the U.S. dollar in the past four months.

The Japanese market saw significant gains, with the Nikkei 225 index climbing 0.94% to close at 42,224.02. This surge was largely attributed to a strong performance by technology stocks. Similarly, the broader Topix index also rallied, rising 0.69% to reach a new peak of 2,929.17. South Korea, the Kospi index increased by 0.75%, as the Bank of Korea maintained its interest rate at 3.5%. The tech-centric Kosdaq index modestly rose by 0.11%.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include DAL, & PEP. After the bell we have no notable reports.

News & Technicals’

PepsiCo’s financial performance in the second quarter presented a mixed picture, as the company fell short of Wall Street’s revenue expectations. This shortfall was primarily due to a decrease in volume across its three North American business units. In light of these results, PepsiCo has adopted a more conservative stance regarding its sales forecast for the entire year, signaling a cautious approach amid uncertain market conditions. Despite the revenue setback, the company managed to surpass earnings estimates for the quarter, indicating that while sales volume may have declined, profitability metrics and cost management strategies could have yielded better-than-expected outcomes. This divergence between revenue and earnings highlights the complex challenges and operational efficiencies within PepsiCo’s business operations.

The U.S. Treasury Department and the Internal Revenue Service (IRS) have reported a significant milestone in tax collection efforts, having recovered over $1 billion in tax debt from high-income individuals in the past year. This achievement underscores the government’s intensified focus on ensuring tax compliance among the wealthy. In a strategic move to bolster these efforts, the IRS announced in September its intention to heighten scrutiny on individuals earning in excess of $1 million per year who have substantial tax debts exceeding $250,000. This initiative represents a concerted push to enhance the integrity of the tax system and address the tax gap by targeting those with the highest earning brackets and significant outstanding tax obligations. The announcement serves as a reminder of the IRS’s commitment to fair tax enforcement and the importance of compliance with tax laws.

In a landmark decision, EU antitrust regulators have endorsed a set of commitments from Apple, marking a significant shift in the tech giant’s approach to its contactless payment technology. This development paves the way for competitors to access Apple’s tap and go payment system, potentially altering the landscape of digital payments in Europe. EU antitrust chief Margrethe Vestager highlighted the move as a pivotal change that promises to enhance competition and consumer choice. This announcement follows the European Commission’s initiation of an antitrust probe concerning Apple Pay back in 2020, reflecting the EU’s ongoing efforts to ensure fair competition in the digital market. The acceptance of these commitments by Apple indicates a willingness to comply with regulatory standards and could set a precedent for other tech companies operating within the EU.

The highly anticipated inflation report and the jobless claims with likely set the tenor for today’s trading. Will the reaction follow-though with the bullish surge the ended the Wednesday session or, will the bears find reason to whipsaw the indexes back down? Buckle up we will soon find out so plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.