As inflation fears subsided, the index chart technicals continued to improve yesterday. That said, price action remains challenging, and it’s worth noting that this all-or-nothing market environment has swung up and down nearly 2000 points in the last 7-days. Challenging may be an understatement! We still have overhead resistance levels to overcome, so be careful chasing stocks well above support and near resistance. New records may be just around the corner, but we still can’t rule out bear attacks near resistance highs. Stay focused on price action for clues.

Overnight Asian markets rallied strongly, led by SHANGHAI surging 2.40% by the close of trading. Across the pond, the DAX hits an all-time high while the FTSE and CAC trade oddly near the flatline. Ahead of earnings, Case-Shiller, Housing data, and Consumer Confidence numbers, the U.S futures push for another bullish gap up open.

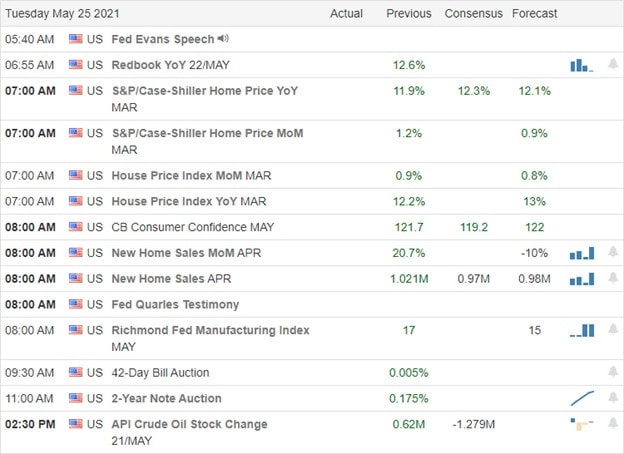

Economic Calendar

Earnings Calendar

We have under 25 companies reporting today, but we have several potential market movers on the list. Notable reports include A, AZO, CBRL, INTU, NAT, JWN, RRGB, SOL, TOL, URBN, & ZS.

New & Technicals’

Elon Musk said he spoke to bitcoin miners, and after doing so, the price surged to near $40,000. Make you wonder how much longer the SEC will allow him to get away with this manipulation and why would anyone want to own something that one person can move the price so dramatically. What’s the next move, Elon? Amazon could announce a deal as early as today to buy MGM Studios. The $9 billion deal would be AMZN’s biggest acquisition since the Whole Foods purchase in 2017. Ahead of Case-Shiller numbers and the New Home Sale figures, Treasuries are drifting lower this morning. The 10-year fell to 1.591%, and the 30-year dipped to 2.283%. After one denial after another, the evidence begins to mount that Covid-19 came from a Wuhan Lab. The WHO has repeatedly said the virus jumped from bast to humans, but there is no evidence that the virus exists in bat populations after extensive testing.

Chart technicals continued to improve yesterday as inflation fears subsided. The tech giants enjoyed substantial rallies pushing indexes toward resistance levels. In this all-or-nothing market environment, I would not rule out the possibility of new record highs in the DIA or SPY by the end of the week. However, with the recent volatility, we should also not rule out the possibility of another bear attack near market highs. Keep in mind the Dow has covered nearly 2000 points in just the last 7-day of trading.

Interestingly the Absolute Market Breadth indicator continues to decline as we surge higher. It is, however, encouraging that the VIX suggests market fear is subsiding. Stay focused and flexible as volatile price action is likely to remain challenging.

Trade Wisely,

Doug

Comments are closed.