Yesterday the bulls pulled off an impressive hold of price support and the 50-day averages of the DIA, SPY, and IWM with the oil and financial sectors leading the way. The question today is will that rally continue heading into the weekend after a big morning of economic reports that set shockingly bad market records. This morning futures are quite volatile as they wait for the big data drop. Buckle up for the possibility of a wild ride.

Asian markets close overnight little changed even after reporting there industrial output number came in better than expected. European markets trade mixed its eye on economic reports and uncertain economic reopening. US futures indicate anything is possible by the time the market opens as they grapple with a substantial economic data drop.

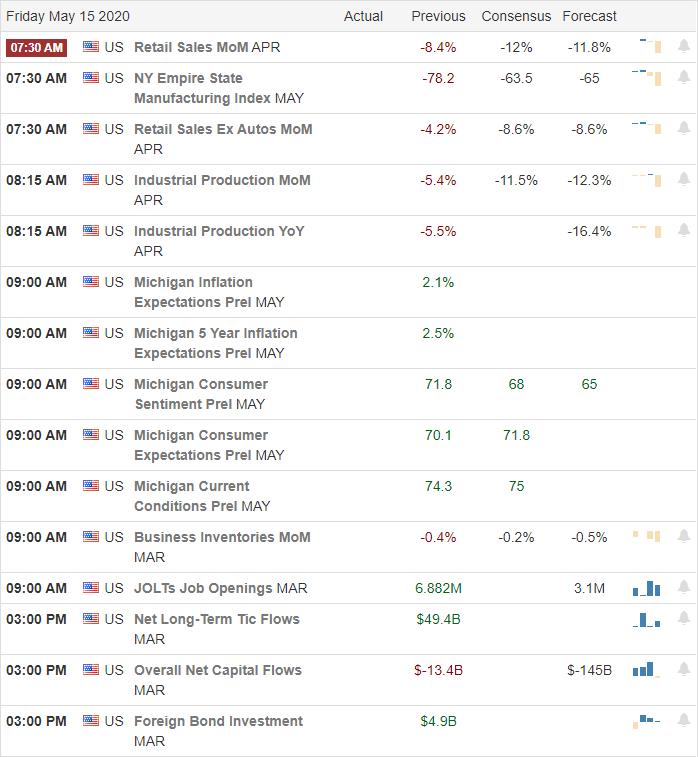

Economic Calendar

Earnings Calendar

On the Friday earnings calendar, we have more than 170 companies reporting quarterly results. Notable reports include DKNG, JD, MFG, PBF, & VFC.

Technically Speaking

After a very rocky start on Thursday morning, the bulls stepped up, putting in a solid defense of critical price support levels. Oil and financial stocks led the rally with JPM recovering 4% and AXP lifting more than 7%. Follow the Jerome Powells call for additional Congressional stimulus the President appears likely to support another round of direct payments to citizens. The House plans to vote on a 3 trillion dollar plan as early as today, but Senate leadership continues to say it will not support the current bill. What comes next is unclear, but it seems the pressure for policymakers to continue to rack more up historic deficit spending measures soon.

Yesterday’s rally created an impressive hold of the 50-day average on the DOW, SPY, and IWM indexes. The market-leading QQQ maintained a comfortable cushion between its price and critical averages. Futures this morning are showing a considerable amount of volatility ahead of a big day of economic data. Topping that list is Retail Sales with estimates suggesting a historic decline in consumer spending is likely. In just the last hour, futures have gone from pointing to a bullish open to now suggesting a substantial gap down. Plan for considerable volatility as we head into a weekend of uncertainty as more and more states try to reopen their economy.

Trade Wisely,

Doug

Comments are closed.