The House of Mouse (DIS) surprised the market yesterday, reporting it had gained 10 million new subscribers on the first day of service, pushing the stock up more than 7% on the day and taking the Dow to record highs in the process. FOMC Chairman Jerome Powell testified yesterday they will back off on rate cuts adopting a wait and see approach siting a strong economy led by solid jobs growth. Mr. Powell speaks today with the House Budget Committee giving us a one day reprieve from the impeachment hearings.

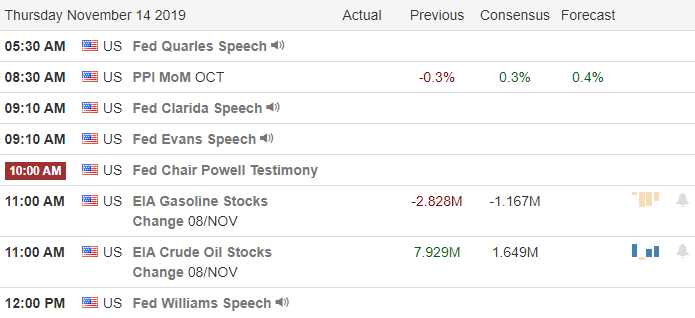

Asian markets closed the day mixed and mostly lower on trade war tensions as they demand more tariff cuts. European indexes are trading flat to mostly lower this morning in reaction to the apparent stalemate in US/China trade talks. US Futures currently suggest a flat open but have improved after WMT reported an earnings beat this morning. Jobless Claims and PPI numbers are out 8:30 AM Eastern as well as a big round of earnings reports, so stay focused on price action for clues.

On the Calendar

On the Thursday Earnings Calendar, we have just over 275 companies reporting quarterly results. Notable reports include WMT, NVDA, AMAT, BAM, CGC, DDS, FTCH, HP, IGT, SCVL, SINA, VIAB, WB, WIX, & WSM.

Action Plan

The Dow powered to new record highs after DIS reported their new streaming service gained 10 million subscribers on its very first day of service. However, this morning, futures are pointing slightly bearish with China not wanting to commit to a level of farm purchases and demanding removal of tariffs. The Congressional impeachment hearing had a huge viewership but seemed to have very little if any impact on the market. We have break in that regard today, but the hearings resume on Friday.

Mr. Powell testified yesterday that after 3-rate cuts, the FOMC is comfortable taking a wait and see approach with future rate cuts unlikely in the near future. The chairman will continue his testimony before the House Budget Committee at 10 AM Eastern today. We have a big day earnings with the retail giant WMT reporting before the bell and NVDA as the most notable after the bell. CSCO disappointed the market yesterday afternoon and is indicated to open substantially lower this morning.

Trade Wisely,

Doug

Comments are closed.