Hopeful vaccine news out of Russia is inspiring the bulls for a gap up open this morning that may well set a new record high in the SP-500. Although Congress continues the battle of soundbites and rhetoric, there is still significant hope they will soon come to an agreement on more stimulus. How this might affect the Presidential executive orders is unclear but slowing the debit spending no longer the issue. It’s the battle of who’s willing to spend the most.

Asian markets closed missed but mostly higher overnight with Hong Kong leading the way up 2.11%. European markets are sharply higher across the board up to more than 2.5% on recovery hopes. US Futures indicate a very bullish gap up open with the SP-500 nearing a new record high ahead of earnings and PPI data.

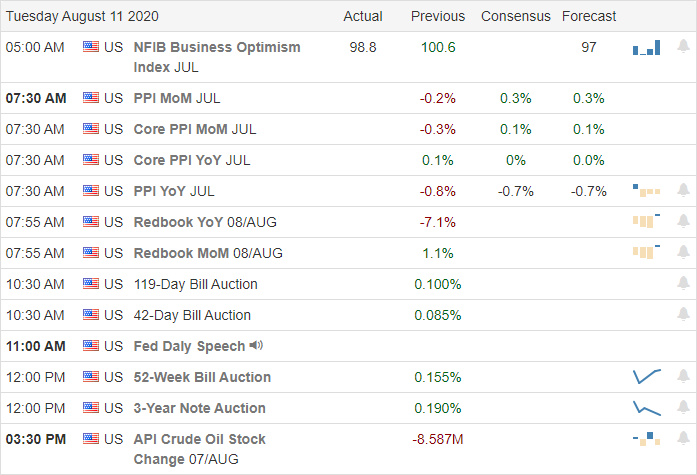

Economic Calendar

Earnings Calendar

On the Tuesday Earnings Calendar, we have a decline, with 88 companies stepping up to report. Notable reports include NIO, GOOS, CSPR, HUYA, IHG, LITE, MAC, MLCO, RRGB, SFTBY, SYY, & VIAV.

News & Technical’s

Yesterday’s bullish move left the SP-500 less than 1% from new record highs. Airlines reported that travel is increasing, providing a big lift to the sector, including a BA which rallied more than 5.5%. Heavy equipment manufacturers DE, CAT, and CMI buying surged yesterday with energy and financial sectors also gaining ground. During the night, Russia claims the development of the world’s first coronavirus vaccine lifting the futures markets sharply higher this morning. Of course, a lot of testing will have to is required before the acceptance of a new vaccine here in the US, but with global cases topping, 20 million hope is high. New US sanctions against Chinese government officials yesterday once again ratchet up tensions between the countries, adding uncertainty to global banks. As MSFT works to buy TikTok, the French government opens an investigation into privacy concerns of the popular social media App.

With the bulls solidly in control and the futures pointing to a bullish gap open, the SP-500 is likely to reach a new record high. Traders should be careful not to chase stocks already well within a bullish run with the fear of missing out. Remember, this will be the 8th straight day of gains, increasing the odds of a market rest or pullback at any time. The T2122 indicator this buying wave is very stretched, and a new record high could be the catalyst that brings out some profit-takers. Having said that, we should rule out the possibility that Congressional Stimulus news could provide another shot of energy for the bulls. Stay focused, flexible, and plan your trading carefully.

Trade Wisley,

Doug

Comments are closed.