As stimulus hope fades and a coronavirus resurgence here in the U.S. and Europe, overnight futures markets point to a nasty gap down ahead of market-moving earnings and economic reports. The swirling uncertainty continues to make price action very volatile and dangerous, likely chopping up accounts of the inexperienced. Today’s news could quickly improve or worsen this morning open, so plan your risk carefully and work to avoid emotionally charged decisions.

Asian markets slip south across the board overnight, and European markets are decidedly bearish this morning after France declares a public health emergency. Ahead of earnings and economic data that included jobless numbers futures suggest a nasty gap and more price volatility for the traders to navigate.

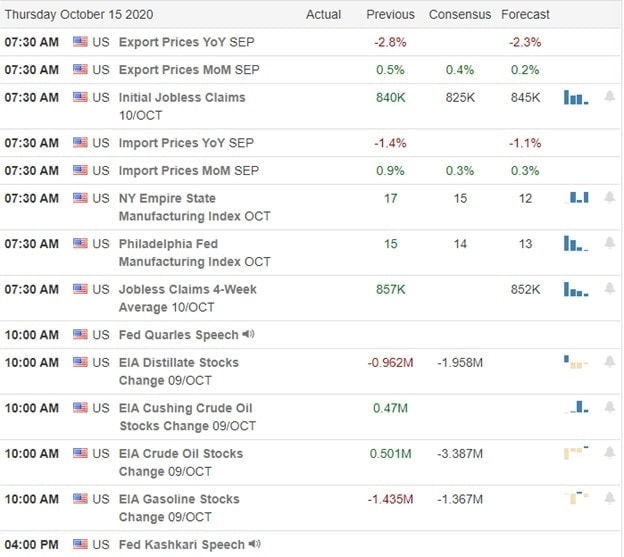

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have 13 verified reports rolling out today. Notable reports include UAL, DAL, SCHW, TACO, ISRG, MS, TFC, & WBA.

News & Technicals’

The bears made some headway yesterday, pushing the indexes lower after a report suggesting the hoped-for stimulus before election day fades. Additional reports reviled the speaker Pelosi spoke to Munchin yesterday and plans to continue the stimulus conversation later today but noted there remains a vast divide in viewpoints. Coronavirus is once again front and center in this morning’s news, with France declaring a public health emergency and Europe scrambling to control the reemergence with new lockdown procedures. Here in the U.S., the infection rates are also surging again, topping more than 50,000 for the second day in a row. Sadly the death toll is also rising, weighing the market sentiment heading into today’s open and piling on to the bad news coronavirus clinical trails are pausing over safety concerns. As the election season politics shifts into high gear, the second presidential debate is being replaced with dueling town hall meetings. What could go wrong with that?

All this uncertainty seems to have energized the bears this morning, with the futures pointing to a substantial gap down this morning. However, with several notable earnings and economic reports headed our way before the open, we could easily see an improvement or a worsening of this volatile overnight swing. Buckle up; it could be a wild ride today.

Trade Wisely,

Doug

Comments are closed.