Asian markets closed higher overnight even after China manufacturing numbers declined for the 3rd straight month. European markets are also higher across the board this morning due to fresh US-China trade comments according to CNBC. Consequently, US Futures are pointing to a substantial gap up this morning supposedly in reaction to yesterday’s GDP number if you believe the news.

Currently the futures suggest a gap of more than 175 Dow points this morning to test key resistance index levels. Those caught short could enhance the bullish move, buying to cover in a so-called short squeeze. We should also be on guard for the possibility of a pop and drop pattern at or near price resistance. Don’t chase with the fear of missing out, take a breath and wait to see if buyers step in supporting the gap before adding risk ahead of the weekend.

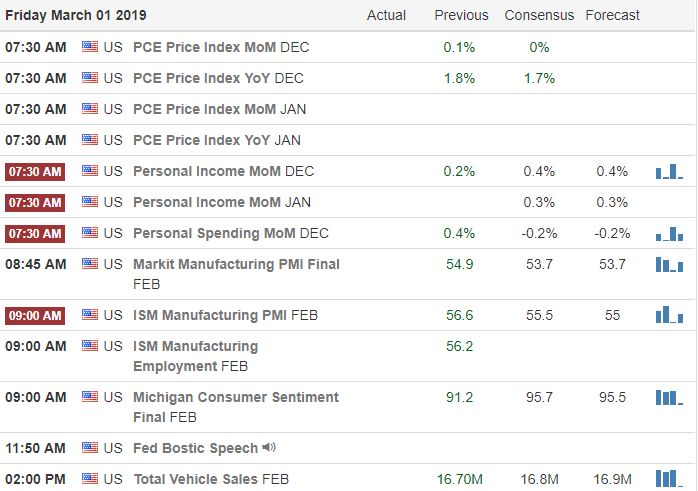

On the Calendar

We get a little break on the Earnings Calendar with just 50 companies reporting earnings today. Notable reports today are XRAY, FL and SNH.

Action Plan

Futures are sharply higher this morning though I’m not sure why other than the bulls just want to go up. CNBC is suggesting it due to US/China trade comments but the only story I can find on the subject suggests that Intellectual Property Theft remains a major sticking point. There is also a suggestion that the market is responding to yesterday’s strong GDP news. Odd, but okay. Nonetheless we are looking at a substantial gap up this morning and those caught short may trigger a short squeeze this morning.

Although we have a lighter day on the earnings calendar we have several potential market-moving economic reports this reports morning. Remember to not chase a morning gap especially right into price resistance. Wait to see if buyers step in supporting the gap because we don’t want to get caught in a classic pop and drop at price resistance. If resistance does break an attack of record market highs may be in the cards. Have a fantastic weekend everyone!

Trade Wisely,

Doug

Comments are closed.