Asian markets closed bullish across the board following the lead of US markets after setting new records. European markets are modestly bullish across the board as the monitor US/China trade developments closely. US Futures currently point to a Dow gap up of nearly 75 points ahead of a huge day of earnings reports.

New record after new record on a rally very few expected, but it looks as if the bulls want to stretch even further this morning on high hopes of the Phase 1 deal. Yesterday was rather frustrating, technically producing a pop and drop pattern that chopped in a very small range after the big gap up. Ahead of a big day of earnings and economic reports futures markets once again point to a gap open that we will have to again watch for proof of follow-through buying. Guard yourself against chasing into the gap as profit-taking could begin at any time.

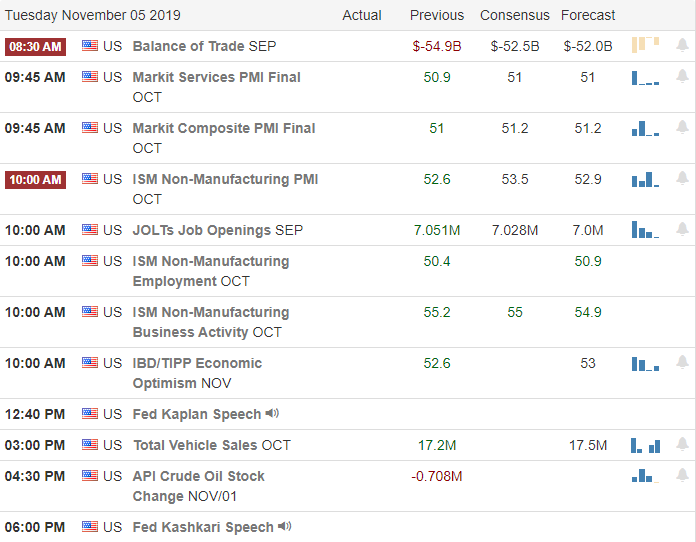

On the Calendar

On the Tuesday earnings calendar, we have over 360 companies reporting results. Notable reports include PTON, AGN, AINV, ARNC, BDX, CZR, CWH, CNK, DVA, DVN, EMR, HST, HUBS, LAMR, LC, LPX, MNK, MTCH, MYL, NEM, PBI, PAA, PPL, RRGB, REGN, SSTK, TPR, TRVG, TRUP, VOYA, & WW.

Action Plan

Yesterday was a bit frustrating with a big institutional gap that found no follow-through chopping in a very small range the entire day. Of course, we set new records in the DIA, SPY, and QQQ, and it looks as if we could do the same today with another gap up open indicated in the futures. The T2122 indicator settled after the morning gap, which gives a bit more up-side room if the bulls continue to find inspiration.

With a big day of earnings reports and the International Trade in goods report at 8:30 AM, anything is possible, but with high hopes of a Phase 1 trade deal the bulls appear relentless in their run higher. As the melt-up continues, stay focused on price watching for clues of profit-taking beginning. It’s very easy in such a bullish environment to get caught up in the euphoria and over-trade so late in the rally. Remember, gap up opens can be a great time to take some profits and be careful not to chase stocks that have already run multiple days higher.

Trade Wisely,

Doug

Comments are closed.