Although a lighter day on the earnings calendar, we have some heavy hitters stepping up to the plate with impressive pandemic results inspiring the futures higher this morning. Should the bulls remain motivated throughout the day, the SP-500 may finally close at a new record high joining the NASDAQ in the winner’s circle. Bullish momentum could undoubtedly use some improvement with far more stocks pulling back or consolidating with just a select few pushing the indexes higher. Perhaps today’s big reports can help cure that issue.

Asian markets closed trading with modest gains though mixed with the NIKKEI slightly lower due to new virus concerns. European markets, however, are green across the board this morning, led by the DAX up nearly 1% on the day. Fulled up on strong earnings results form WMT and HD, US futures point to a bullish open and a likely new record for the SP-500.

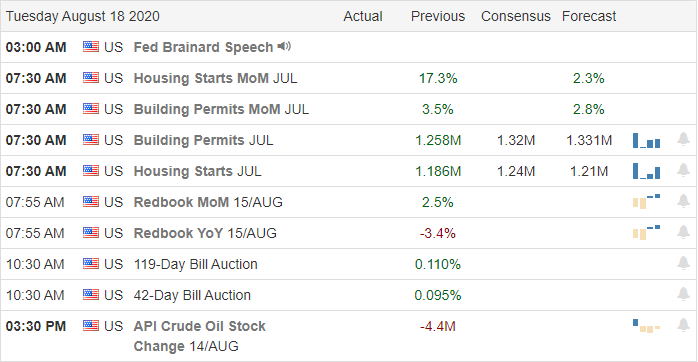

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have a lighter day with just 17 companies reporting quarterly results. Notable reports include HD, AAP, A, AMCR, CREE, JKHY, KSS, LZB, SE, & WMT.

News & Technical’s

The early report from HD said quarterly sales lept higher more than 20% as DIY consumers stuck home during the pandemic began home improvement projects. The bullish report has futures pointing to a higher open with the SP-500 likely to join the NASDAQ in the new record high club. However, with several notable reports yet to come this morning, anything is possible by the open. It looks like Oracle is setting up a bidding war looking to challenge Microsoft for a shot at buying TikTok. Markets typically embrace high priced bidding wars and could continue to inspire the bulls. On a bearish note, the coronavirus has now claimed the lives of more than 170,000 Americans with daily infection numbers averaging more than 50K. That said, Congress adjourned for the rest of the summer without a stimulus deal, and as far as I can tell, no plan as to when they might try again. One thing for sure is that both parties will be trying to direct blame at each other in a colossal finger-pointing match as election rhetoric ramps up.

Technically speaking, the indexes remain in bullish trends, but directional momentum has become noticeably weak. Once again, the market found enough energy to push the NASDAQ to new record highs as the Absolute Market Breadth Index declined. With several notable earnings reports, an expectation of increasing Housing Starts perhaps we see that momentum burst to resolve the divergence.

Trade Wisely,

Doug

Comments are closed.