The bulls stampeded back into stocks after gaping substantially lower yesterday, choosing to hear no evil or see no evil in the new, more infectious strain of the virus impacting Europe. In a late-night session, the U.S. House passed the stimulus bill and spending bill, avoiding a government shutdown. Now traders will have to answer the question, is the stimulus already priced into the market? Currently, futures are flat, while yesterday’s bullish price action raises hope of a Santa Claus rally.

Overnight Asian markets dipped in reaction to the new economic restrictions weighing on investors. After a rough day of selling yesterday, European markets trade modestly higher this morning despite the new virus strain’s economic impacts. After receiving the government go-ahead for the 2nd largest stimulus bill in government history, U. S. futures are taking a wait and see approach ahead economic reports.

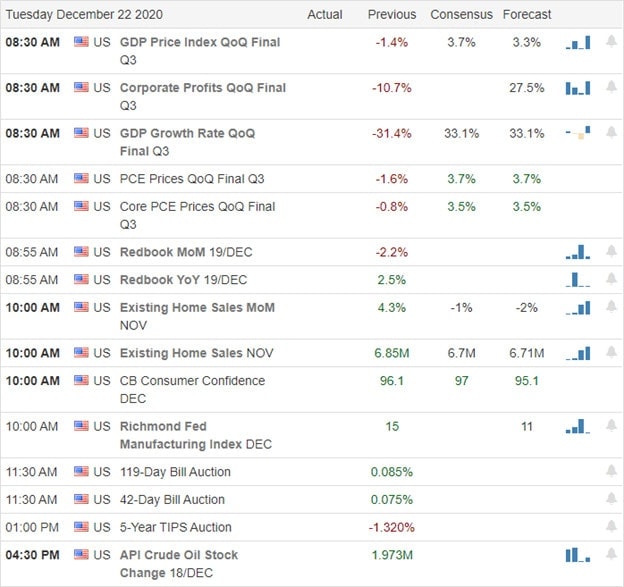

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have just 4-verified reports. Notable reports include KMX, CTAS, & NEOG.

News & Technicals’

After weeks of political gamesmanship, the U.S. House passed the 2nd largest stimulus bill in government history. Americans could get the $600 direct payments as soon as next week and extend a lending program for business and up to 15 billion in aid to airlines. Google and Facebook are reportedly teaming up to battle antitrust lawsuits that have raised the possible collusion between the companies to price fix advertising prices. The SEC has been very busy of late and, according to reports, will soon sue the cryptocurrency firm Ripple for selling unregistered securities. The new strain highly contagious strain of the virus is already suspected to be here in the U.S., according to Whitehouse health officials. Scientists from the U.K. suggest the new strain is up to 70% more contagious. However, the market chose to ignore the new threat to the economy in favor of the new deficit spending bill in a highly volatile trading session yesterday. According to Johns Hopkins data, the U.S. is recording at least 215,700 new infections and at least 2600 deaths each day based on a seven-day average.

After some wild price action whipsaws, the bulls rushed back in yesterday as if they have zero concern about the overall economy’s state. However, after passing the $900 billion stimulus plan, the U.S. Futures seem to have stalled this morning. Printing bullish candle patterns on the index charts suggest there is still hope for a Santa Claus rally as we head toward the Christmas shutdown. We have many potentially market-moving data coming our way on the economic calendar today and tomorrow, so stay focused and expect price sensitivity to the news cycle. Will we continue to hear no evil and see no evil as economic impacts continue to grow?

Trade Wisely,

Doug

Comments are closed.