The Biden win on Super Tuesday, the IMF approving $50 Billion and the House passing $8.3 in virus spending brought out the bulls yesterday with the healthcare sector leading the way. Although the Dow surged more than 1100 points this morning the Dow futures suggest a good portion of the move will be taken back in an overnight gap down. Such is the nature of a market that’s facing so much uncertainty. While I would like to think the volatility will soon get better I have to remember we are just at the very beginning of the outbreak here in the US. I suspect the wild price gyrations will continue to make for very challenging trading for the near future.

Asian markets rallied sharply overnight in reaction to Wall Streets’ big move and the IMF $50 billion in virus relief. Unfortunately, European markets are decidedly bearish this morning and the US Futures point to a disappointing overnight reversal gap punishing those that bought up stocks yesterday hoping the relief rally was underway. Expect the extreme volatility to continue as we move toward the uncertainty of the weekend.

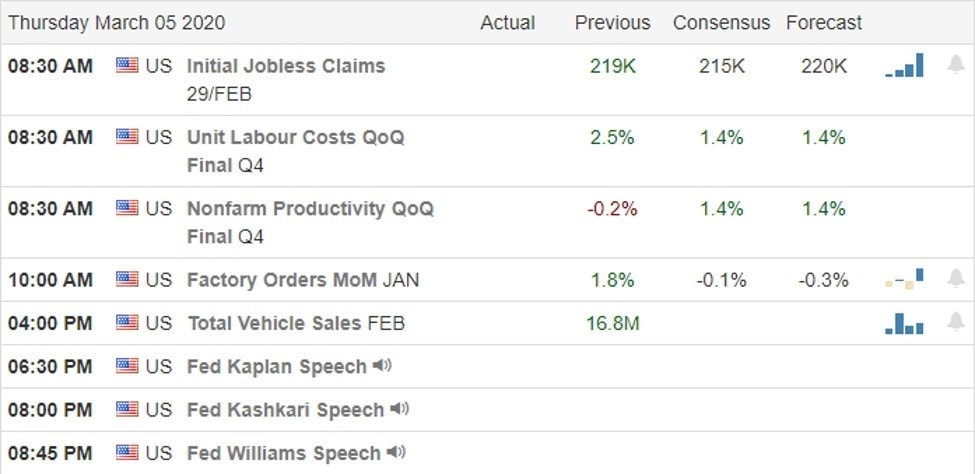

On the Calendar

Earnings Calendar

No the Thursday earnings calendar we have our biggest day this week with 230 companies reporting results. Notable reports include COST, ADT, AOBC, BJ, BURL, CHUY, HRB, KTB, KR, FIZZ, PLUG & TTC.

Top Stories

A huge surge of bullishness led by the healthcare sector after the more moderate Joe Biden became the leading candidate for the democratic party. The buying accelerated throughout the afternoon session with hopeful traders looking for a relief rally.

The US House passes and 8.3 billion dollar emergency spending plan to battle the coronavirus and the IMF puts up more than 50 billion in aid to help defray the massive health care costs of the fast-spreading virus.

Airlines continue to cancel 1000’s of flights due to lack of demand parking unneeded aircraft. The industry now projects losses that could reach 113 billion. Italy may suspend budget rules to pass a 5.6 billion dollar virus package after yesterday ordering all schools closed for 2-weeks. Iran has now set up checkpoints between cities and closed all schools and universities trying to curb the spread of the very contagious virus. Last night China reported an increased relapse rate with patients getting the virus once again.

Technically Speaking

Yesterday’s rally pushed the Dow up to test its 200-day average and a significant price resistance level. The SPY once again broke back above its 200-day average while the technically strong QQQ lifted back up toward its 50-day. The beleaguered IWM rallied but remained substantially below its 200- day average. With so much price volatility its hard to make heads or tails of any technicals on daily charts. Expect the wild price action to continue as the uncertainty here in the US continues to grow.

Acton Plan

Although risking sounding like a broken record, traders should be very careful in this very volatile price action environment. Overnight price action swings are very dangerous for anyone other than day-traders. Just a day after the Dow surged more than 1100 points the Dow futures suggest a huge reversal this morning gapping substantially lower. As we head into the uncertainty of the weekend anything is possible. With our biggest day of earings this week, several potential market-moving economic reports and the likelihood of disturbing virus news trader should continue to expect extreme volatility. While this sell-off was traumatic I’m not sure we have reached a point of capitulation. With the outbreak in the US just in the beginning stages we should not rule out the possibility of a retest of recent lows or perhaps even deeper losses in the near future. Plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.