New of more government stimulus provides the bullish energy to set new NASDAQ records amid rising infections, hospitalizations, and deaths. Europe leaders reach a deal to provide another $858 billion (US Value) in stimulus, and reports suggest Congress is aiming at a total that will top 1 trillion. There seems to no lack of desire to buy up stocks at any price as many issues hit new record highs yesterday ahead of earnings their earnings reports. With a light day of economic news, earnings and stimulus news will take front and center as futures push for another record high open today.

Asian markets traded higher overnight, supported by hopeful vaccine news. European markets are decidedly bullish in reaction to the stimulus deal, and the US futures all point to a bullish gap-up open fueled by more government deficit spending. Continue to ride the wave as long as it lasts.

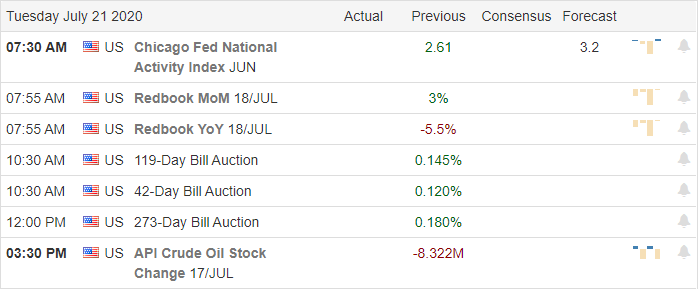

Economic Calendar

Earnings Calendar

On the Tuesday earnings calendar, we have 43 companies stepping up to report results today. Notable reports include CNI, COF, KO, CMA, IBKR, ISRG, IRBT, LMT, LOGI, NAVI, NVS, PM, PLD, SNAP, SYF, TER, TXN, & UBS.

News & Technical’s

Hopeful vaccine news and lots of talk about government stimulus big tech led Monday’s rally that inked another all-time high close for the NASDAQ. At the same time, virtual infections, hospitalizations, and deaths rose. According to reports, EU leaders reached a deal of fiscal stimulus that totals $858 billion, and the US is shooting for a plan that will add at least another trillion in US stimulus. A new study from New York suggests that as many of 1/3 of businesses will never reopen due to pandemic impacts, but as of now, the market seems utterly unconcerned about unemployment. UBS reported an 11% fall in second-quarter profits early this morning and warned of continued credit losses, but the stock is gapping up this morning. KO reported a 33% decline in earnings; however, it sees demand improving as lockdowns ease, pushing the shares higher this morning. Chicago took steps to increase COVID restrictions yesterday, and according to reports, LA County is on the cusp of another shut-down in the battle against the virus.

DIA, SPY & IWM setup yesterday with bullish patterns with the big-5 tech giants doing the majority of the lifting. The QQQ hit new record highs, and the US futures point to more records at the open as the race to buy stocks at all-time highs continues. With a very light day on the economic calendar, earnings reports and government stimulus news will take front and center. Somehow COVID, unemployment, and year over year, declining company revenues no longer matter. Stay with the bullish trend but remain focused and flexible because this sensitive news market has proven several times how quickly it can reverse.

Trade Wisely,

Doug

Comments are closed.