As the Nasdaq prints, another record high the US also sets a new national record of Covid-19 infections and health officials as calling for a federal policy to curb the spread. While on the surface, the market appears to have absolutely no concerns, yet the VIX remains quite elevated, and the Absolute Breadth Index continues to decline. An interesting dichotomy that could produce a bullish short squeeze or an attack by the bears as recovery concerns mount. Stay focused and flexible as the market grapples with what comes next.

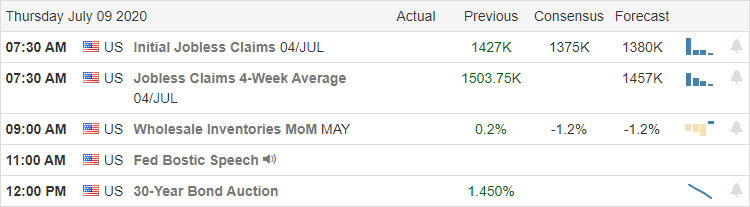

Asian markets continue their bullish run with week lead by China, which rose 1.39%. European markets have seesawed between gains and loss this morning as they cautiously monitor pandemic numbers and the challenging recovery. Ahead of a light day of earnings and another round of jobless claims US futures point to a slightly lower open.

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have just 11 companies reporting quarterly results. Notable reports include WBA, BNED, FC, HELE, PSMT, & WDFC.

News and Technical’s

The bulls refuse to lose continuing to buy up the big tech giants with NASDAQ setting another record high lead by AAPL, which also closed the day at a record high. As the market continues to surge, so does the pandemic infections, hitting a new national record of 60,000 new cases reported in a single day. Health officials are calling for a federal policy action to curb the spread of the virus, suggesting another shutdown may be necessary. A new study warns of a potential wave of brain damage as an aftereffect of Covid-19 infections. The research shows patients suffering from temporary brain dysfunction, strokes, nerve damage, or other serious brain effects. A scary thought considering the US is now dealing with more than 3 million that have already been affected by the virus. According to reports, there is already a noticeable pullback in driving activity as people choose to stay home rather than risking infection. United Airlines warns that half of its workforce may be furloughed, suggesting up to 36,000 people could see their jobs cut as recovery hopes fade in the recent weeks. Bed Bath & Beyond announced they would close 200 stores after reporting a sharp sales decline of nearly 50%, and the Pier One said it would not reopen retail stores in their bankruptcy reorganization moving to online sales only.

Technically speaking, the DIA, SPY, and IWM indicate a possible higher low could be forming after yesterday’s rally, yet at the same time struggling with overhead resistance and potentially bearish candle patterns. Adding to the confusion is the fact that the VIX remains elevated, and the Absolute Breadth Index continues to decline. I see the potential for a bullish short squeeze and, at the same time, see the possibility that the bears could soon attack at any time due to growing recovery concerns. It’s also odd to see indexes setting new records while at the same time precious metals continue rally sharply. Ahead of weekly jobless numbers, the futures currently point to a slightly lower open. Stay focused on price action and remain flexible and prepared for just about anything.

Trade Wisely,

Doug

Comments are closed.