Stock futures rose on Thursday as investors aimed to rebound from the previous session’s declines the a GDP in focus. Wall Street seemed to shrug off Nvidia’s post-earnings dip, with attention shifting to upcoming economic reports, including GDP, International Trade, and Jobless Claims data, set to be released before the market opens. Additionally, the market is expected to find direction from earnings reports, particularly those with a retail focus, throughout the day.

European markets traded higher on Thursday as investors focused on economic data from the region. While oil and gas stocks saw a slight pullback, the tech sector experienced a notable rise of 1.87%. Germany’s preliminary consumer price index for August was reported at 2.2%, and economic sentiment improved in both the euro area and the European Union.

Asia-Pacific markets experienced a downturn on Thursday, primarily driven by declines in tech stocks following Nvidia’s second-quarter results. South Korean and Taiwanese indexes were notably impacted, with South Korean chip giant SK Hynix plummeting 5.35% and Samsung Electronics dropping over 3%. These significant losses in tech stocks led to the Kospi falling by 1.02%, closing at 2,662.28, marking the steepest decline in the region.

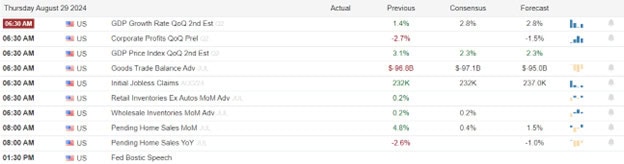

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include FLWS, SEO, BBY, BIRK, BF.B, BURL, DG, GMS, MBUU, MCFT, OLLI, PLAB, RY, & TITN. After the bell include ADSK, DELL, DOMO, ESTC, GAP, HCP, LULU, MRVL, & MDB.

News & Technicals’

Nvidia shares declined in U.S. premarket trading on Thursday, even though the company’s fiscal second-quarter results surpassed estimates. The high expectations for the chipmaker meant that merely beating estimates wasn’t enough to boost the stock significantly. Analysts noted that Nvidia would have needed to exceed all expectations by a substantial margin to see a positive reaction in its stock price. This pullback follows an impressive rally, with Nvidia’s shares having surged over 150% this year. The recent dip highlights the challenges of maintaining momentum after such a significant rise.

Salesforce reported strong fiscal second-quarter results, surpassing estimates and prompting the company to raise its full-year profit outlook. In addition to the positive financial news, Salesforce announced that its Chief Financial Officer, Amy Weaver, will be stepping down. Weaver will remain with the company until a successor is appointed and will continue to serve as an advisor. This transition comes amidst a period of robust performance for Salesforce, highlighting both its financial strength and commitment to smooth leadership transitions.

CrowdStrike reported stronger-than-expected quarterly results but lowered its full-year guidance due to incentives offered in a customer commitment package following a widespread outage on July 19. The cybersecurity software company issued an apology to its customers and partners for the disruption. However, it now faces class action lawsuits and a legal threat from Delta Air Lines. This situation underscores the challenges CrowdStrike is navigating despite its robust performance.

Shares of Super Micro plummeted 19% on Wednesday following the company’s announcement that it would not file its annual report for the fiscal year on time. This decline was further exacerbated by Hindenburg Research’s disclosure of a short position in the company, accompanied by allegations of “fresh evidence of accounting manipulation.” However, analysts at JPMorgan have expressed skepticism about Hindenburg’s claims, describing the report as “largely void of details around alleged wrongdoings from the company.” This situation has created significant uncertainty and volatility for Super Micro’s stock.

Traders should brace for volatility this morning as the market opens higher, influenced by the recent Nvidia report and GDP in focus. The current gap up continues to reflect an overbought condition, so it’s crucial to tighten stops to safeguard gains and be prepared for potential whipsaws. Looking ahead, it’s important to keep in mind that Friday will bring the Fed’s preferred Core PCE inflation report, which could further impact price volatility.

Trade Wisely,

Doug

Comments are closed.