Gap Fill?

Sadly yesterday’s hyped up big gap unfortunately and not that unsurprisingly found profit takers and raising the concern of an immediate gap fill. In Monday’s morning note and market prep video, I cautioned about the possibility of a pop and drop pattern. I received a lot of comments and emailed about making a great call, but please understand that was not a prediction. It was merely an observation after an unbiased study of the index charts.

Sadly yesterday’s hyped up big gap unfortunately and not that unsurprisingly found profit takers and raising the concern of an immediate gap fill. In Monday’s morning note and market prep video, I cautioned about the possibility of a pop and drop pattern. I received a lot of comments and emailed about making a great call, but please understand that was not a prediction. It was merely an observation after an unbiased study of the index charts.

Believe me; anyone can do what I do if you study the chart for what it is rather than what you want it to be. All you have to do is remove your bias, set aside your emotion and focus on the clues left in the price action of the chart. Today, with the market pointing a triple-digit gap we once again must be careful not to chase. Watch the price action a see if the bears pile on after the open supporting the bearish gap or if the bull set up to defend price support. Keep in mind; the market closes Wednesday for the national day of mourning and Friday night the government faces a shutdown. Plan your risk carefully as anything is possible with the market re-opens Thursday morning.

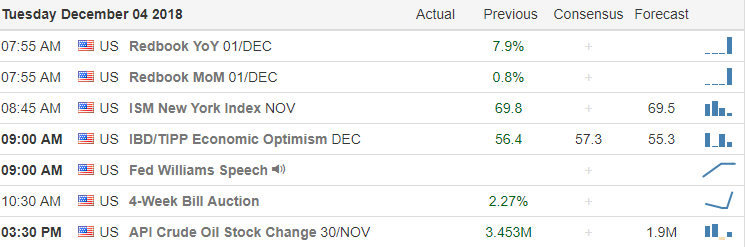

On the Calendar

On the Earnings Calendar, we have just over 30 companies reporting this morning, and there are 25 on the calendar reporting even with the closed on Wednesday.

Action Plan

Despite all the morning hype surrounding the trade negotiations and resulting in huge morning gap, the market found mostly sellers after the open. They are following through with that sentiment this morning with the futures pointing to 100 point gap down and opening the door for a possible fill of yesterday’s gap. With the market closed on Wednesday for a national day of mourning the possible government closure on Friday night, the market is understandably pensive.

The market is also beginning to worry about the possibility of a recession as it watches for the possibility of a yield curve inversion. Although I’m expecting the market remain quite volatile, I would not be at all surprised to see the price action become light and choppy today as we head into the Wednesday closure. With yet another triple point gap we must be careful not to chase and wait to see if sellers pile on in support of the bearish gap or if the bulls set up to defend support levels after the morning rush. Remember anything is possible Thursday morning when the market reopens so plan your risk carefully.

Trade Wisely,

Doug

[button_2 color=”green” align=”center” href=”https://youtu.be/HugXDWqJldE”]Morning Market Prep Video[/button_2]

Comments are closed.