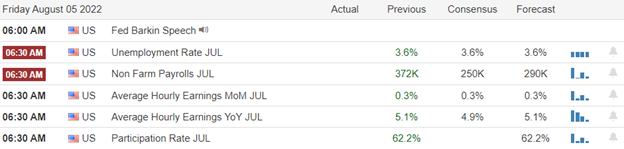

With the indexes stuck in consolidation at significant overhead resistance, the battle for the market’s future direction could be a bit choppy as we wait on the Wednesday CPI and Thursday PPI reports. Of course, we will also have to deal with another busy week of earnings reports keeping market emotion high. In light of the hot jobs numbers, the talking head narrative that inflation topped last month is now in question, so plan for another hectic week as the data rolls out. It would not be unreasonable to expect some wide-ranging choppy price action as we hurry up and wait.

As we slept, Asian markets trading in a muted, choppy session with Hong Kong tech stocks slid lower with Chinese expanded military drills around Taiwan. However, European markets trade modestly green across the board this morning. With a busy earnings calendar, U.S. futures have recovered from overnight losses pointing to a bullish open as the battle continues at resistance for the future direction of the market with inflation data waiting in the wings.

Economic Calendar

Earnings Calendar

We kick off a new trading week with more than 200 companies listed, but many of them are unconfirmed. Notable reports include DDD, ACAD, BIRD, AIG, GOLD, BNTX, BLNK, CBT, CARG, APPS, D, ELAN, ENR, FRPT, GBT, GDRX, GRPN, IFF, LMND, VAC, NWSA, NE, NVAX, OKE, PLTR, PUBM, QLYS, RDRW, SDC, SWCH, TTWO, SKT, TSN, UPST, & VRM.

News & Technicals’

SoftBank posted one of its biggest losses at its Vision Fund investment unit for its fiscal first quarter, as technology stocks continue to get hammered amid rising interest rates. As a result, the Japanese giant’s Vision Fund posted a 2.93 trillion Japanese yen ($21.68 billion) loss for the June quarter. This is the second-largest quarterly loss for the Vision Fund. According to a court document, Celsius has withdrawn its motion to bring back ex-CFO Rod Bolger at $92,000 a month, prorated over a period of at least six weeks. The notice of withdrawal came just ahead of a hearing scheduled for Aug. 8 to review it. The decision to dismiss the motion came three days after CNBC first reported on the request to enlist the help of Bolger as a consultant during the bankruptcy process. China’s Eastern Theatre Command said it would conduct joint drills focusing on anti-submarine and sea assault operations — confirming the fears of some security analysts and diplomats that Beijing would continue to maintain pressure on Taiwan’s defenses. Pelosi’s visit to Taiwan last week infuriated China, which regards the self-ruled island as its own, and responded with test launches of ballistic missiles over Taipei for the first time and ditched some lines of dialogue with Washington. The duration and location of the latest drills are unknown, but Taiwan has already eased flight restrictions near the six earlier Chinese exercise areas surrounding the island. Fed Governor Michelle Bowman said she supports the central bank’s recent 0.75 percentage point rate increases and believes they should continue until inflation is subdued. “I think similarly sized increases should be on the table until we see inflation declining in a consistent, meaningful, and lasting way,” she added in a Saturday speech. Markets anticipate a third big increase when the central bank meets again in September. Treasury yields declined slightly in early Monday trading, with the 2-year at 3.21%, the 5-year at 2.93%, the 10-year at 2.80%, and the 30-year at 3.03%.

As we begin a new trading week, the indexes remain in consolidation at significant as the bulls and bears battle for the future direction of the market. We have another big week of earnings to keep the price action volatile, but all eyes will likely be on the CPI and PPI later in the week. In addition, last Friday’s hot jobs number raised questions about the overall inflation narrative having topped. The Senate passage of another massive spending bill that levies taxes on companies and shareholders may have some adverse side effects in the fight against inflation. Only time will tell but expect some positive and negative reactions in targeted market sectors. With a two-day wait for the CPI report, it would not be surprising to see some wide-ranging chop due to the uncertainty. Plan carefully and avoid overtrading as we wait.

Trade Wisely,

Doug

Comments are closed.