Though we had a week of blowout earnings, the price action that followed made for a very frustrating week as it chopped sideways with little to no momentum. With the futures once again pushing hard in the pre-market, the question is will this time be different, or will it turn out to be just another pop and drop that we experienced several times over the last couple of weeks? Overall index trends are still bullish but stay focused and flexible with a busy week of earnings ahead.

Asian markets closed in the red across the board overnight with Twain tensions rising and India reeling from pandemic infection rates. However, European indexes trade higher this morning, with the U.K. closed to celebrate their May Day holiday. Here in the U.S., the pre-market pump has begun ahead of a busy day of earnings as well as manufacturing data. Will there be some follow-through or another frustrating whipsaw? Plan your risk carefully.

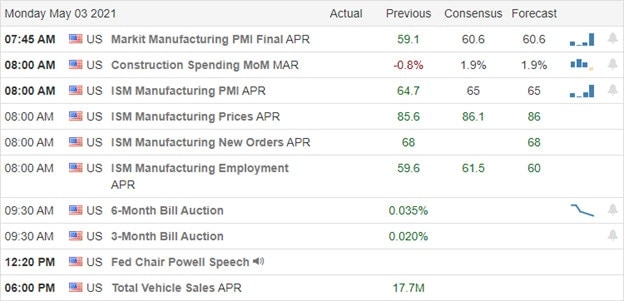

Economic Calendar

Earnings Calendar

Kicking off the first week of May, we have more than 100 companies reporting quarterly results. Notable reports include AMG, ALK, WEK, APO, CAR, CBT, CHGG, CC, FANG, EL, FN, GPP, IRBT, L, MOS, RMBS, ON, PETS, RBC, RIG, & XPO.

News & Technicals’

Warren Buffett announced his successor, CEO Greg ABEL when he would be no longer man the helm of Berkshire Hathaway. Treasury yields dipped slightly this morning ahead of the manufacturing data, with the 10-year coming in at 1.625% and the 30-year traded flat at 2.298%. The Phillippine secretary of foreign affairs accused Beijing of strainings its friendship with the Philippines. In a Twitter post, Locsin asked China to “get the f— out!” Keep a close eye on this as the war of words escalates with Taiwan clearly in China’s crosshairs. The president will out touring the country trying to sell the infrastructure bill to the public as Congress continues to wangle over the size and scope. As India’s pandemic numbers spike, the U.S. discusses a more comprehensive licensing of vaccines that may waive patent protections. Over the weekend, India reported more than 400,000 daily cases bringing the countries total to nearly 20 million. On Friday, the White House announced that it would restrict travel from India.

There’s no doubt that last week was a confusing and frustrating week of price action as companies report blowout results while the market showed little to no interest. Technically speaking, the bullish trend remains intact though the price action has lingered in a wide-ranging consolidation. For some reason, the pre-market futures appear inspired to get moving this morning, but once again, I feel it’s necessary to suggest caution in case of another pop and drop. Don’t case, instead let’s wait to make sure there is some actual buying after the open with enough momentum to last more than a few minutes. With a big week of earnings and news, stay focused and flexible.

Trade Wisely,

Doug

Comments are closed.