Although we have more than 350 companies reporting, all eyes will be on the FOMC rate decision at 2:00 PM Eastern today. In anticipation of a rate cut, the Dow and SP-500 have rallied more than 10% since the discussion began in early June. One has to wonder after such a huge anticipation run what might occur if the FOMC disappoints the market. One thing for sure is that the entire world is watching and we should expect considerable volatility as a result. Trade negotiations with China ended very sharply after just half a day of conversation, but that’s likely to get lost in the shadow of the FOMC today.

Overnight, Asian market closed in the red across the board, but European markets trade mixed, however, mostly higher ahead of the FOMC decision. US Futures are pointing to a bullish open fueled by the earnings that have come in largely better than expected this quarter. Expect a flurry of price volatility during the morning rush as the market reacts to a big round of earnings reports but don’t be surprised if that quickly fades into choppy light action as we wait for the Fed. Fasten your seat-belt and prepare for a wild news-driven day.

On the Calendar

On the Wednesday Earnings calendar, we reach the half-way point for this season. We have more than 350 companies stepping up to report. Among the notable today are, ABC, mt, ADM, AVP, CC, CI, CLX, ED, CROC, DVA, DISH, DNKN, DD, ETSY, EXC, FSLR, GM, GPRO, HBI, HFC, IRM, K, LM, NNN, PINS, RMAX, RDFN, SHOP, SQ, STOR, X, VZ, W, WU, WING, WYNN, XYL, YETI, and YUM.

Action Plan

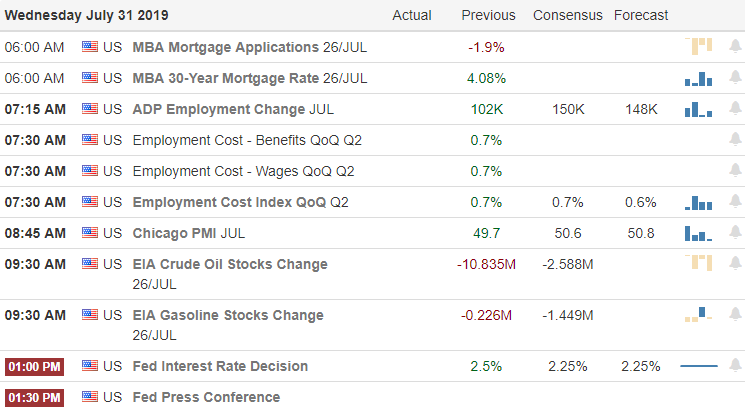

After a choppy day of price action that left the DIA, SPY, and QQQ slightly lower on the day the big round of earnings after the bell seems to have lifted the spirit fo the bulls this morning. AAPL beat analysts estimates and guided positively forward although iPhone sales slumped. Today at 2 PM Eastern we will finally get the decision from the FOMC on interest rates. However, before that occurs, we will get word on the ADP Employment numbers, Employment Cost Index, and the Petroleum Statis Report along with a very large group of earnings reports.

It’s going to be a very busy day of data, but as of now, the Futures are pointing to a bullish open. Expect volatility to during the morning rush as trader react to earnings reports but don’t be surprised if price action becomes very light and choppy leading into the rate decision. There has been so much news spin around this rate decision that the entire world is waiting in anticipation so expect an explosion of the volatility after the release and during the Chairmans press conference. Buckle up it may prove to be a very bumpy ride today.

Trade Wisely,

Doug

Comments are closed.