On Wednesday, the relief rally extended, but the sentiment reversed after Facebook stubbed its toe, triggering a substantial-tech selloff after the bell. It is interesting to note that although indexes gained yesterday, we had more declining issues than advancing issues. Traders ignored the negative economic data yesterday, but now we turn our attention to jobless claims and the pending Employment Situation number on Friday. Expect some wild price volatility as the market reacts to a nasty earnings-driven overnight reversal.

Asian markets traded mixed but mostly lower overnight as economic data, and geopolitical tension weigh on investors. This morning, European markets see red across the board reacting to earnings as they wait for an ECB decision. U.S. futures point to an overnight reversal ahead of a busy day of earnings and economic reports.

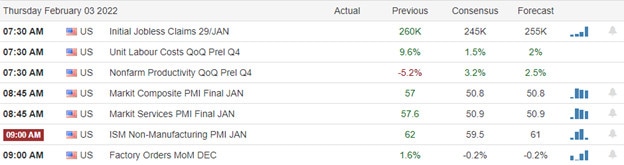

Economic Calendar

Earnings Calendar

We have the busiest day of the week on the earnings calendar this Thursday, with nearly 200 companies listed. Notable reports include F, ABB, ABMD, ATVI, ALL, AMZN, APTV, BDX, BIIB, BYD, CTLP, CAH, CI, CLX, COP, CTVA, CMI, DECK, LLY, EL, GPRO, HAIN, HBI, HIG, HSY, HON, ICE, LAZ, LITE, MRK, MTOR, MCPH, NWS, NTDOY, NOK, NLOK, PH, PENN, PINS, POST, PRU, DGX, RL, RHHBY, SKX, SWKS, SNAP, SU, SYNA, TAK, U, GWW, WRK, & WWE.

News & Technicals’

Facebook earnings came in below expectations for the fourth quarter, and the company said numerous challenges are ahead in the first quarter. Inflation, supply chain disruptions at advertisers, and users shifting to products that “monetize at lower rates” are among the company’s key issues. Revenue in the first quarter will be between $27 billion and $29 billion, while analysts were looking for that number to top $30 billion. In addition, Facebook said on Wednesday that Apple’s App Tracking Transparency feature would decrease the company’s 2022 sales by about $10 billion. Facebook’s admission is the most concrete data point so far on the impact to the advertising industry from Apple’s privacy change introduced last year. The privacy feature disrupts the behind-the-scenes mechanics of mobile ads, especially those that confirm whether a purchase or download was made. Nintendo has sold 103.54 million Switch units since its release in early 2017. In comparison, the company has sold 101.63 million units of the Wii since its release in 2006. It’s a big milestone for the Switch, as the Wii was one of Nintendo’s most popular consoles. Like many other consumer electronics companies, Nintendo has been grappling with a shortage of components, particularly semiconductors that power its devices. Wormhole, one of the most popular bridges linking the Ethereum and Solana blockchains, lost about $320 million in an apparent hack Wednesday afternoon. The two blockchains are popular in the world of Defi, where programmable contracts can replace lawyers and bankers in some transactions and NFTs. But few users stick with one blockchain exclusively, so bridges like Wormhole are a necessary go-between. Treasury yields moved slightly higher in early Thursday trading, with the 10-year rising to 1.7788% and the 30-year edging higher to 2.1156%.

The rally continued Wednesday, but interestingly, we had more declining issues than advancing issues. Then, however, Facebook stubbed its toe, triggering a tech selloff after the bell that sets the stage for an overnight reversal. The huge miss on the ADP jobs numbers was largely ignored yesterday, but we will now focus on the weekly Jobless claims and the pending Employment Situation number Friday morning. Expect price action volatility to remain high with nearly 200 earnings reports today to keep traders on edge and emotions high. AMZN will be the big hitter after the bell today that can move the market substantially.

Trade Wisely,

Doug

Comments are closed.