Ahead of the Employment Situation report, U.S. futures see nothing but bullishness, pushing for more record highs at the open. Let’s keep our fingers crossed that the pandemic, which is shutting down business all over the country, has not yet trickled into employment. The NASDAQ set its 47th new high record for the year in yesterday’s bull run even as hospitalizations reach critical capacity issues and the death toll surges. Have a plan just in case the market suddenly decides to care because it’s a long way to the daily 50-moving average.

Asian markets closed Friday trading mixed as SMIC shares plunge in Hong Kong after the Pentagon blacklisting. European market trade cautiously higher focused on U.S. stimulus efforts and Brexit issues. With a light day on the earnings calendar, the U.S. futures point to more recording highs ahead of the government’s reading on employment.

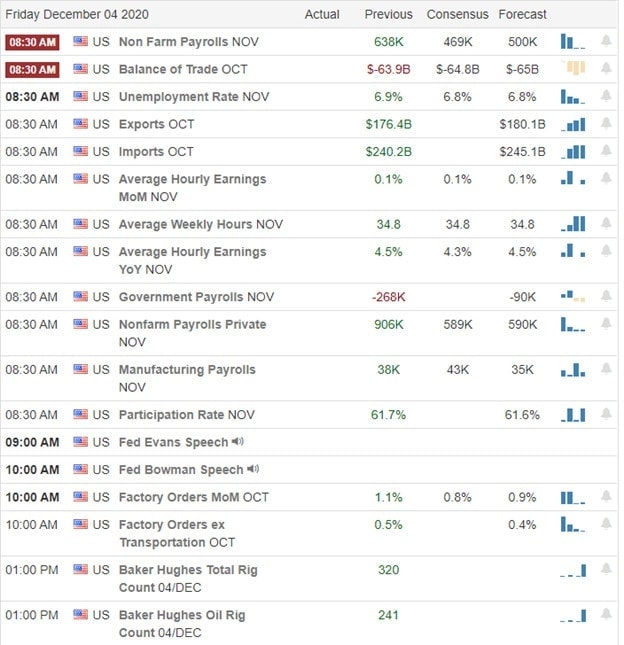

Economic Calendar

Economic Calendar

We have a light day on the Friday earnings calendar. Notable reports include BIG & GCO.

News and Technicals’

Bulls remain large and in charge, with the Nasdaq making it 47th new record high this year. News that suggested distribution issues with the new Phizer vaccine created a wild whipsaw near the end of the day. That said, the current market shakes off any concerning news, and the bulls rush back, bidding up already stretched and high priced stocks. Biden is endorsing the latest Covid stimulus deal saying it’s a good start, which would suggest even more deficit spending is on the way in his administration. A lot is riding on the 900 billion stimulus package success as Congress rushes to avoid a government shutdown on December 11th. In a surprising move, Warner Media announced that all scheduled 2021 new movies would simultaneously release to movie theaters and the HboMax.com streaming service. A massive blow to the theater business and a reminder of how the pandemic is reshaping the business landscape. Not that market cares, but there were more than 210,000 new infections reported yesterday and nearly 3000 deaths as hospitalizations soar, straining healthcare capacity. Also, in the news, the Pentagon blacklists China chipmaker SMIC and oil producer CNOOC in a reaction to a long history of Chinese espionage complaints.

Trends are most certainly bullish, and although all my trades are long positions, I’m becoming more and more concerned about the overextension I see so many stocks. Trade with the trend but guard yourself against overtrading and chasing already extend stocks. As yesterday’s vaccine news triggered the end of the day, whipsaw reminds us just how sensitive this market is and how quickly significant profits can disappear.

Trade Wisely,

Doug

Comments are closed.