As we begin a new week, an economic uncertainty continues to grow as the fast-spreading virus threatens shutdowns and fills hospitals ICU units to capacity. However, the market seems relatively undeterred with visions of enormous government stimulus spending hopes on the horizon in Europe and the United States. The big question yet to be answered is, can we deficit spend enough to cover the business impacts of the pandemic? With a light economic calendar, a busy earnings calendar, and pandemic uncertainty rising expect price action to remain volatile and challenging.

Asian markets closed the overnight mixed but mostly higher as the SHANGHAI rallied more than 3%. European markets trade mixed with EU leaders deadlocked on a massive stimulus coronavirus recovery fund. US futures have rallied off overnight lows ahead of earnings reports indicating a flat to slightly bearish open with NASDAQ futures bank in the green. Buckle-up and stay focused and flexible.

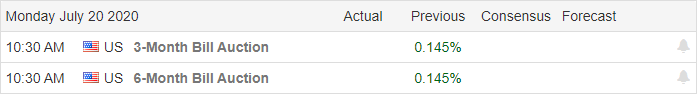

Economic Calendar

Earnings Calendar

On the Monday earnings calendar, we have 22 companies reporting quarterly results. Notable reports include PEP, HAL, MAN, PETS, CCK, IBM, LOGI & STLD.

News and Technical’s

Concern is rising as US infection rates top 3.7 million with a death toll moving over 140,000 this weekend. Florida has reported more than 10,000 new infections in the last 5-days as space in ICU units in several hot spot states are reportedly at capacity. As the healthcare system strains to keep up, the market seems transfixed on hopes of massive government stimulus in the pipeline in Europe and the United States. I guess the question yet to be answered is, can the government actually buy our way out of this pandemic without a massive debt crisis as the after effect? I guess only time will tell. I think one of the most honest answers I’ve heard came from Jamie Dimon’s warning for the US economy this weekend, “nobody knows what comes next.”

Technically the indexes continue in bullish trends even with the palpable uncertainty that lies ahead. This week we have a relatively light economic calendar, but traders will have to navigate a minefield of earnings reports the could create some significant price volatility. Futures opened on a positive note last night but quickly slipped negative, suggesting that Florida may have to shut down once again. However, in the normal fashion of late, the morning pump has rallied the futures well of the lows currently indicating a flat to everso slight bearish open as we wait on morning earnings. Stay flexible with an ear to the news that could quickly create reversals both up and down.

Trade Wisely,

Doug

Comments are closed.