S&P 500 futures edged slightly higher on Wednesday with investors eagerly awaiting Nvidia’s quarterly earnings announcement. Wall Street is particularly focused on Nvidia to assess the ongoing viability of the tech and AI sectors. The semiconductor giant’s performance is seen as a key indicator for the broader market trends in these industries. Nvidia is scheduled to release its earnings report after the market closes, making it a pivotal moment for investors tracking the tech and AI trade.

European markets saw an uptick on Wednesday as investors turned their attention to new earnings reports and economic data. While mining stocks dipped by 0.87%, the chemicals sector experienced a gain of 1.02%, and insurance stocks increased by 1.01%. Additionally, data from the French statistics office indicated a slight improvement in household confidence regarding the country’s economic outlook in August.

Asia-Pacific markets experienced a mixed performance recently, with China’s CSI 300 index reaching its lowest point in nearly seven months. In Australia, the Consumer Price Index (CPI) saw a year-on-year increase of 3.5%, slightly surpassing the 3.4% forecasted by economists polled by Reuters, but showing a decrease from the 3.8% recorded in June. The minutes from the latest meeting of the Reserve Bank of Australia (RBA) revealed that the central bank had contemplated raising interest rates as part of its efforts to control inflation.

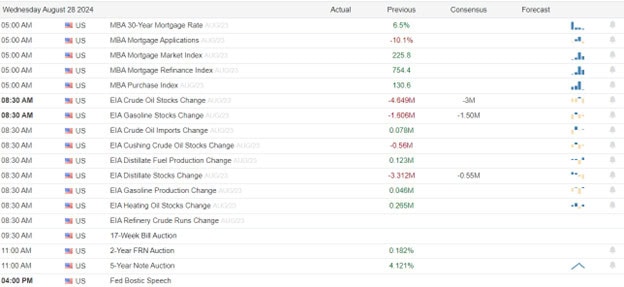

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include ANF, BMO, BBWI, CHWY, DCI, FL, SJM, KSS, LI, & PDCO. After the bell include NVDA, CRM, AFRM, COO, CRWD, FIVE, GEF, HPQ, NTAP, NTNX, OKTA, VEEV, & VSCO.

News & Technicals’

China’s state media has sharply criticized Canada for its decision to impose over 100% import tariffs on Chinese electric vehicles, using more forceful language than the official government response. The editor of the Global Times, a Beijing government mouthpiece, accused Canada of “shooting itself in the foot” by adopting U.S. protectionist policies. In contrast, Canada defended the tariffs, stating that they are intended to “level the playing field for Canadian workers” and support domestic producers of electric vehicles, steel, and aluminum in both domestic and international markets.

Cryptocurrencies continued their downward trend from Tuesday, influenced by lower Asia futures, which led to significant liquidations on the Bybit exchange. Data from CoinGlass revealed that the futures market experienced $93.52 million in long ether liquidations and $85.93 million in bitcoin liquidations. This wave of liquidations underscores the volatility in the cryptocurrency market and the impact of broader market trends on digital assets.

Lego reported a 13% increase in revenue for the first half of the year, reaching 31 billion Danish krone (approximately $4.65 billion). The company attributed this growth to strong performance across its product lines, particularly Lego Icons and Lego Creator, as well as its collaboration with Epic Games’ Fortnite. Despite a slowdown in consumer spending on big-ticket items in China, Lego remains optimistic about the long-term potential in the region. This positive outlook reflects Lego’s strategic focus on innovation and partnerships to drive sustained growth.

Nordstrom exceeded Wall Street’s earnings expectations, thanks to its successful cost-cutting measures and efficiency improvements. However, despite this strong performance, the company provided cautious guidance for the full year, citing a decline in demand for luxury goods. To drive growth, Nordstrom has increasingly relied on its off-price division, Nordstrom Rack. This strategy highlights the company’s adaptability in navigating a challenging retail environment while seeking to maintain profitability.

There is palpable anticipation in today’s market condition with traders eagerly awaiting Nvidia and what it might mean for the overall market. However, let’s not forget the big market moving economic reports coming Thursday and Friday before the bell so be careful not to caught up in hype with a fear of missing out. Choppy price action could exist most of today as we wait but I would plan for considerable price volatility after the Nvidia earnings straight though to the Core PCE figures Friday morning. Plan your risk carefully.

Trade Wisely,

Doug

Comments are closed.