The bulls lifted the Dow above 32,000 for the first time in history as the market celebrates the passage of one of the biggest spending bills of all time. Treasury yields also softened after a successful 10-bond auction sending industrial and consumer defensive stocks soaring as big tech continued to suffer. With more than 150 earings reports, Jobless Claims, JOLTS, and a 30-year bond auction ahead, the bulls push for another gap up open to keep the party going. Be careful not to chase such an extended rally because a significant pullback could begin at any time but until then, enjoy the ride!

Asian markets advanced overnight, led by the Hong Kong surging 1.65% at the close of the session. European markets traded mixed this morning as they chop cautiously around the flatline waiting for the next move of the ECB. U.S. Futures want the bullish party to continue pointing to a gap up open ahead of earnings and jobs data.

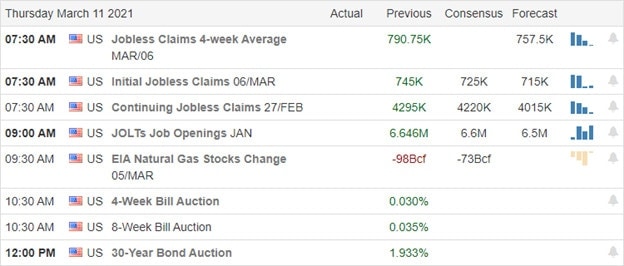

Economic Calendar

Earnings Calendar

As usual, Thursday is the busiest day of the week on the earnings calendar, with more than 150 companies reporting quarterly results. Notable reports include DOCU, LOCO, XONE, GCO, GOGO, GRDX, J.D., PRTY, PBPB, STNE, TTSH, TLYS, ULTA, MTN, WPM, & ZUMZ.

News & Technicals’

The passage of the stimulus bill lit a fire under the bulls pushing Dow above 32,000 for the first time in history. It is one of the biggest spending packages in history and the first legislative win for President Biden. Simultaneously, the President is under heavy pressure with more than 150,000 illegal border crossings in February, setting new records. The 10-year treasury yield softened slightly after a quick and successful auction yesterday afternoon. Today there will be a 30-year auction that to keep an eye on at 1 PM eastern. Denmark suspends using the AstraZeneca Covid vaccine after severe cases of blood clots reported in those vaccinated. President Biden will speak to the nation in a prime-time address on Thursday where he plans to announce the “next phase” of his pandemic response.

When it comes to the chart technicals, there is no question that bulls are large and in charge in the Dow, cementing new records prices. Although the NASDAQ has also enjoyed a nice relief rally, big tech continues to struggle with price resistance levels closing the day well below its 50-day average. Industrial and consumer defensive sectors continue to see substantial rallies as the massive rotation of the pandemic high flyers hits a fevered pitch. Be very cautious not to chase overextended stocks. With such a massive point rally in just a few days as a substantial pullback would not be out of the question and could begin at any time. Until then, enjoy the ride as the market celebrates the creation of deficit spending.

Trade Wisely,

Doug

Comments are closed.