Don’t bother us with warnings of possible virus economic impacts; we’ve got money to spend no matter how high the price rises! LOL, a little sarcasm as the bulls continue to the relentless push higher while more central banks warn of the financial and economic effects of the outbreak. Even though some profit-takers took advantage of yesterday’s morning gap the SP-500 and the Nasdaq held on to new closing record highs. What looked like the setup for a possible pullback by the end of the day now appears to have been just a brief rest as the bulls continue to party like its 1999. Stay long, continue to profit, but be very careful chasing already very extended stocks.

Asian markets shrugged off the virus’s concerns surging upward and closing green across the board. The European markets also in rally mode this morning and decidedly bullish across the board. Ahead of more than 150 earnings report and busy day Fed speak US Futures once again leap higher with the Dow expected to gap more than 100 points. Buckle up and enjoy the ride.

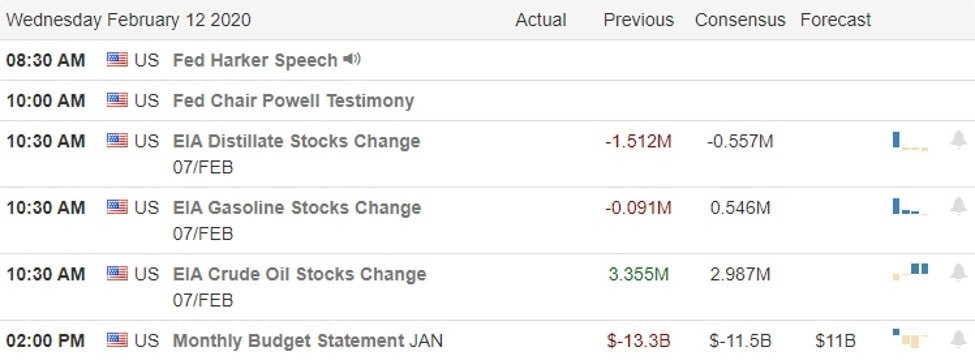

On the Calendar

On the Hump Day earnings calendar, we have a busy day with just over 150 companies reporting results. Notable reports include AB, NLY, AMAT, ARCC, ARES, GOLD, BG, CTL, CSCO, CAME, CVS, EFX, EQIX, FOSL, HUBS, IPG, LGC, MRO, MGM, SHOP, TAP, MCO, NTAP, NBL, STAG, SPWR, TEVA, TRIP, TRVG, & WELL.

Action Plan

Bernie Sanders comes out as a de-facto leader after a narrow win in New Hampshire with former Vice-President Joe Biden slipping to 5th place showing. Latecomer Mike Bloomberg has chosen not to participate in the first few contests placing his bet not on the people but instead on the hundreds of millions he is willing to spend to bypass the process. The outbreak numbers continue to grow with several more central banks sounding the alarm of financial and economic impacts. With more than 44,000 confirmed cases and over 1100 dead the market continues to charge forward definitely. Though parabolic chart patterns have developed in some of the leading stocks, investors seem willing to cover their eyes hold their nose and buy no matter the elevation.

Although the morning gap found some profit-takers, the SP-500 and Nasdaq both squeaked out new closing record highs while the DIA closed flat. What looked like a possibility of a pullback developing now appears to have been nothing more than a little rest with the US Futures pointing to another gap up open. So with a big day of earnings reports and another busy day of Fed speak lets party like its 1999! Then again, if you’re like me disciplined to a trading plan and a set of rules, you’ll avoid chasing extended stocks, continue to plan your risk carefully, taking profits along the way and watchful for changes in sentiment that could happen at any time.

Trade Wisely,

Doug

Comments are closed.