In a display of force, the bulls rushed into the morning session seeming buying with both hands quickly pushing the Dow up 200 points. However, about an hour into the day, a switch flipped and, buying fatigue seemed to settle over the market giving back half of the Dow gains by the close. Overall breadth was strong as stock all over the market reached out to new 52 week highs and inking new record index highs. With a light day on the earnings calendar this morning, perhaps the Housing numbers can provide some inspiration.

Asian markets closed green across the board last night but European markets are trading modestly in the red this morning after their record-breaking rally yesterday. US Futures traded in the red most of the night, and this morning continues to suggest a modestly bearish open ahead of earnings and economic reports.

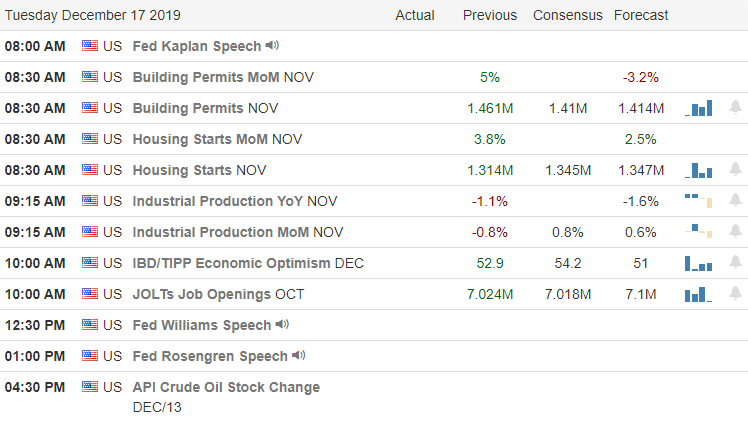

On the Calendar

On the Tuesday Earnings Calendar, we have 17 companies fessing up to quarterly results. Notable reports include CTAS, FDX, JBl & NAV.

Action Plan

In the morning session yesterday it seemed traders could not buy stocks fast enough as the Dow surged more than 200 with good overall breadth. Then suddenly it seemed we hit a point of buyer exhaustion and the rest of the day the market drifted sideways and south giving up 100 of the Dow points previously gained. The strong breadth would suggest there is more bullishness to come but price action itself suggests a little caution with the Dow having left behind a shooting star pattern while the IWM appears stalled at price resistance. The QQQ remained strong through the close, but the SPY printed a hanging man suggesting a little caution is warranted.

Perhaps we can find some inspiration in the Housing Starts number at 8:30 AM which according to consensus estimates, should remain strong. Also, keep an eye on the Industrial Production and JOLTS reports. Futures trading in the red most of the night and at the time of writing this report still suggest a modestly lower open, but that could easily change based on earnings and economic reports. Although the price action is giving us contradictory signals, the overall index trend remains bullish, and thus far, the bears don’t seem to have sharp teeth.

Trade Wisely,

Doug

Comments are closed.