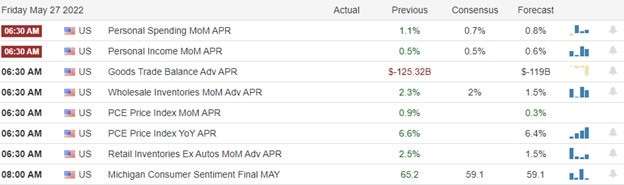

The bulls triggered a short squeeze on Thursday after better than expected results from discount retailers DG and DLTR raised hopes of a strong consumer. Volume was, however, below average, and the negative GDP hints at a slowing economy with more rate hikes from the Fed coming next month. Before the bell today, we read on International Trade and Personal Incomes, followed by Consumer Sentiment numbers shortly after. With significant technical and price resistance above, can the bulls follow through as we head into the uncertainty of a 3-day weekend, or will profit-takers finish this wild week of price action? We will soon find out!

During the night, Asian markets closed their trading week with a relief rally led by Hong Kong, up 2.89%. This morning, European markets see green across the board, working to close the week strong. With a light day of earnings events and potentially market-moving economic data ahead, U.S. futures suggest a muted but bullish open well off of overnight highs.

Economic Calendar

Earnings Calendar

We have a light day on the Friday earnings calendar with only nine verified reports. Notable reports include BIG, HIBB & PDD.

News & Technicals’

Dollar Tree and Dollar General boosted their outlook for the year as shoppers squeezed by inflation seek lower prices. The companies see people buying a different merchandise mix than they were a year ago when they had stimulus dollars in their pockets. The dollar chains are also expanding while strategizing about ways to manage higher costs. According to Realtor.com, the supply of homes for sale jumped 9% last week compared with the same week one year ago. Real estate brokerage Redfin also reported that new listings rose nearly twice as fast in the four weeks ended May 15 as they did during the same period a year ago. According to the National Association of Realtors, pending home sales, a measure of signed contracts on existing homes, dropped nearly 4% in April, month to month and were down just over 9% from April 2021. As economic conditions continue to tighten, a Microsoft executive in charge of Office is telling employees to be more cautious when opening up new roles. Microsoft’s Office and Windows businesses are growing, but they’re not keeping up with the Azure cloud business. Two weeks ago, Microsoft told employees it would increase part of their compensation. Executives from the blockchain and cryptocurrency industry told CNBC that the recent crash in the digital coin market should help get rid of “bad actors.” Billions of dollars of value have been wiped off the cryptocurrency market in the last few weeks, driven by a sell-off in stocks and the collapse of algorithmic stablecoin terraUSD. The executives said that the market shakeout was necessary and called it “healthy.” Treasury yields see little movement in early Friday trading, with the 10-year flat at 2.76% and the 30-year slightly higher at 2.99%.

Better than expected results from discount retailers DG and DLTR raised hopes of a stronger consumer triggering a short squeeze to test index resistance levels with lower than average volume. We were overdue for a relief rally, but with the Dow already up more than 2000 points off the lows, the T2122 indicator suggests a short-term overbought condition. Traders choose to ignore the declining Durable Goods and negative GDP, so it will be interesting to see the reaction to International Trade, Personal Incomes, and Outlays numbers before the bell. We will also take the temperature of the consumer with sentiment numbers at 10:00 AM Eastern. Can the bulls keep the rally going, or could we see some profit-taking heading into the uncertainty of a 3-day weekend? Your guess is as good as mine, but the price action will remain challenging in all likelihood.

Trade Wisely,

Doug

Comments are closed.