U.S. futures indicated a lower opening on Wednesday as investors reacted to disappointing reports from major tech companies Alphabet and Tesla. Shares of Alphabet, Google’s parent company, dropped by 3.4%, while Tesla’s stock saw a more significant decline of over 7% due to results that fell short of expectations. This underperformance from two of the market’s leading tech giants contributed to the overall negative sentiment among investors.

European markets experienced a downturn as the earnings season intensified. Major indexes across the region, along with nearly all sectors, saw declines. Household goods stocks were particularly affected, dropping by 1.55%. In contrast, the travel and leisure sector was the only one to buck the trend, posting a modest gain of 0.62%. Additionally, flash purchasing managers’ index (PMI) data revealed that business activity in the euro zone had stalled in July.

Asia-Pacific markets experienced a downturn as traders evaluated the latest business activity data from Japan and Australia. The technology and electric vehicle (EV) sectors were notably impacted, with stocks in these areas seeing significant declines. In Australia, the private sector’s growth decelerated in July, as indicated by the composite purchasing managers index (PMI) which fell to 50.2 from 50.7 in June, according to Juno Bank.

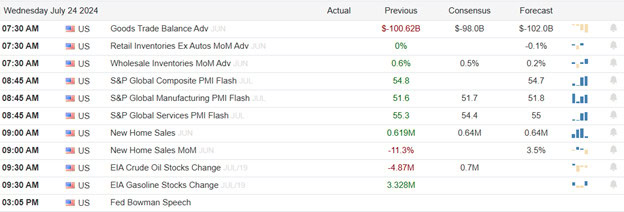

Economic Calendar

Earnings Calendar

Notable reports for Wednesday before the bell include ALKS, ALLE, APH, T, BSX, CHKP, CHE, CME, EVR, FSV, FI, FTV, GEV, GD, GPI, HCSG, IPG, IP, KBH, LW, LII, NAVI, NEE, NEP, ODFL, PPBI, BPOP, PRG, RCI, ROP, SLAB, THMC, TEL, TDY, THC, TMO, TSEM, TNL, UCBI, VRT, WNC, & WFRD. After the bell include ACI, ALGN, AMP, CP, CSL, CLS, CMG, CHDN, CYH, CLB, EW, EPRT, FAF, FLEX, F, GL, GGG, HP, IBM, ICLR, PI, INVH, KALU, KLAC, KNX, MXL, MTH, MEOH, MC, MOH, NEM, OII, ORLY, CASH, PEB, PEGA, PLXS, QS, RNR, RSG, ROL, SLM, NOW, SSB, TER, TYL, URI, UHS, VMI, VKTX, WCN, WM, & WH.

News & Technicals’

Shares in LVMH declined on Wednesday following the release of the luxury group’s earnings for the first half of 2024. The company reported quarterly sales of 20.98 billion euros ($22.7 billion) for the second quarter, which fell short of analysts’ expectations as surveyed by LSEG. Additionally, LVMH disclosed that sales in Asia, excluding Japan, dropped by 14% in the second quarter compared to the same period last year. This underperformance in a key market contributed to the overall negative reaction from investors.

Tesla CEO Elon Musk recently posted an informal poll on social network X, inquiring whether his publicly traded automaker should invest $5 billion into his latest startup, xAI. Established in March 2023 and first publicly discussed in July 2023, xAI focuses on developing large language models and AI products designed to compete with offerings from Google, Microsoft, and OpenAI. Musk’s companies have a history of collaboration and financial interactions, making this potential investment a continuation of his integrated business strategy.

In a Tuesday interview with CNBC’s Jim Cramer, Mattel CEO Ynon Kreiz expressed optimism about the Barbie maker’s success as an independent company. Meanwhile, a Reuters report revealed that private equity firm L Catterton, backed by luxury goods giant LVMH, has approached Mattel with a potential deal. This development highlights the ongoing interest in Mattel’s business and confidence in its prospects.

The ride-hailing company announced that Sverchek’s departure is not due to any disagreements within the company, its board of directors, or management, nor is it related to Lyft’s operations or policies. Despite the exit, Sverchek will receive severance benefits, including a cash payment of $650,000. This clarification aims to reassure stakeholders that the departure is amicable and unrelated to any internal conflicts or operational issues.

Anticipation may have become a little concern after disappointing reports from GOOG and TSLA roused the bears this morning. With a huge number of earnings reports today and tomorrow expect volatility to remain high. Add in the heavy hitting economic reports on the horizon and the stage it set for very challenging market conditions.

Trade Wisely,

Doug

Comments are closed.