Between the earnings and economic calendar, traders and investors will have a lot of data to digest this week. Plan for the considerable price volatility and be prepared for the possibility of overnight reversals with the after the bell giant tech reports with substantial gaps at the open. With P/E ratios already extended, can companies produce earnings results to support these prices? We’re about to find out, so stay focused, flexible, and ready for just about anything.

Asian markets traded very bullishly overnight, with the HSI leading the way up a whopping 2.41%. However, European markets trade in the red across the board, and the U.S. futures that were quite bullish overnight now point to a mixed open. With so much data coming our way, be prepared for considerable price volatility in reaction earnings and economic news.

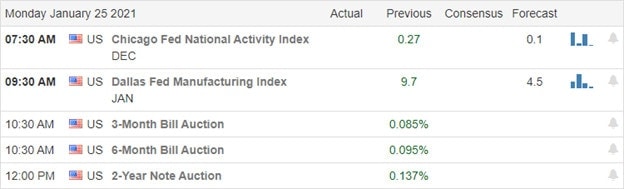

Economic Calendar

Earnings Calendar

We have a busy week of earnings that will include market-moving giant tech reports. Notable reports include AGNC, BRO, CR, ELS, KMB, & STLD.

News & Technicals’

Traders and investors will have a lot of data to digest this week with a busy economic calendar and an earings calendar brimming will market-moving reports. The futures were quite bullish during the night but have moderated considerably this morning, pointing to flat open. However, with so much data coming our way, anything is possible. Treasury yields are falling this morning as investors keep watch on the Biden 1.9 Trillion stimulus plan. The President restricted travel from the U.K., Brazil, and South Africa to mitigate risk from new virus strains that may be vaccine-resistant. In another executive action, Biden extended the student loan freeze for another eight months, and new data shows loans in forbearance are risings, adding pressure to the banking sector.

Although we saw a little selling last week, trends remain bullish, though mainly in a choppy consolidation. The week ahead could prove rather challenging as the market processes a big round of earnings. With P/E ratios already very extended, can companies produce earnings results that support these elevated prices? We will soon see, but traders should expect substantial volatility with the possibility of overnight market reversals and opening gaps as a result. Before making any new trade decision, make sure you’re checking the company’s earnings date as big price moves are possible. Focused, flexible, and agile traders with well-planned trades that carefully manage risk can do well in this environment. Buckle up!

Trade Wisely,

Doug

Comments are closed.