A morning gap down that whipsawed into the green only to be whipsawed once again to new lows is quickly approaching critical weekly index supports. If they fail to hold this selloff could get much worse very quickly. All eyes are on the FOMC and Jerome Powell,wondering if they will stick to their aggressive rate increase stance or if recent events will make them reconsider. If they raise, I suspect the weekly lows will fail. Should they begin to talk more dovish, the market could substantially rally.

Are you willing to gamble on that decision or will you stand aside to protect your capital? Every day I hear from struggling traders searching for answers as they watch their accounts chopped to pieces and suffering huge losses trying to trade the extreme volatility. If you find yourself consistently losing money then stop trading! You’re the boss so make the decision to protect your capital and wait for the market to stabilize. Cash is a position! Better days will eventually return, but if you lose all your capital trying to fight the market, you won’t be here to take advantage of it.

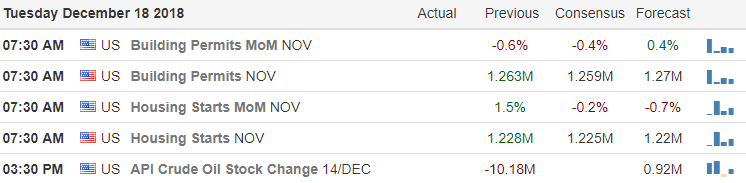

On the Calendar

On the Earnings Calendar, we have 23 companies reporting today. Notable today is FDX, MU, DRI, FDS, JBL, SCS reports.

Action Plan

In yesterdays note I suggested the possibility of a bounce. After the morning gap and some follow-through selling, we did get a bounce. Unfortunately,it lasted for only a couple of hours recovering the morning losses then failing at Friday’s resistance lows creating a double intraday whipsaw. When you look at the index charts its tough to anything but gloom with the financial and political news reinforcing that sentiment. Fear of the unknown is a powerful tool of the bears that have chased away any notion of a Santa rally this year.

As we rapidly approach weekly index supports the market is trying to send a strong signal to the FOMC and Jerome Powell to take a less aggressive approach to interest rate increases. Although it’s not the job of the FOMC to protect the market, they certainly played a part in this selloff. They have signaled a December rate increase is likely, but hopefully, they have received the message of the market and will reconsider. After that, we have the possible closure of the Federal government on Saturday if the Congress and President can’t agree on a budget. Be very careful and remember that cash is a position!

Trade Wisely,

Doug

Comments are closed.