With heavy corporate buybacks pushing U.S. markets, Asia-Pacific markets respond to that bullish energy and experienced a positive start to the week. China’s central bank preserved the one- and five-year loan prime rates at 3.45% and 3.95%, respectively. Hong Kong’s Hang Seng index saw a modest increase of 0.18%. Chinese CSI300 index advanced 0.35%, closing at 3,690.96.

European markets experienced a modest uptick on Monday. The Stoxx 600 index was up 0.17% at 11 a.m. London time. Sector-wise, mining stocks outperformed, registering a 0.8% increase, which could be attributed to rising commodity prices or favorable industry forecasts. On the other hand, banking stocks saw a minor decline of 0.2%, possibly reflecting market adjustments or sector-specific news.

U.S. stock futures saw a slight increase on Monday, after the Dow Jones Industrial Average surpassed the 40,000 milestone for the first time. The Dow futures up 11 points. Meanwhile, S&P 500 futures climbed by 0.1%, and the tech-heavy Nasdaq 100 futures advanced by 0.2%.

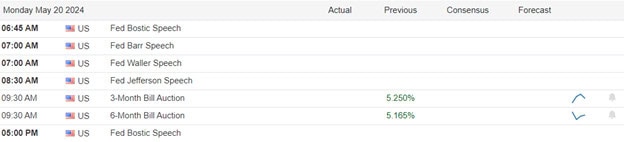

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include GLBE, LI, & WIX. After the bell include KEYS, NDSN, PANW, & ZM.

News & Technicals’

The untimely demise of Iranian President Ebrahim Raisi in a helicopter crash has plunged Iran into a period of uncertainty. The nation, grappling with a severe economic downturn, widespread public dissatisfaction, and escalating geopolitical strains, now faces a pivotal moment. As the world watches, questions arise about the future of this influential Middle Eastern nation, which boasts a population of nearly 90 million and wields considerable clout through its support of various regional proxy factions. Analysts are predicting a likely continuation of the current political trajectory, yet they also highlight the potential for the IRGC, Iran’s formidable revolutionary guard, to tighten its grip on the nation’s governance. This event could mark a significant shift in Iran’s political landscape, with the IRGC poised to steer the country through its complex and challenging circumstances.

The United States’ national debt has soared to a staggering $34.5 trillion, marking an increase of approximately $11 trillion since March 2020. This significant rise has sparked widespread discussion among policymakers and financial experts, with a notable Wall Street firm raising concerns about the potential impact of debt-related expenses on the ongoing stock market rally. The Congressional Budget Office (CBO) projects that the ratio of public debt to GDP will reach unprecedented levels, surpassing any previously recorded in the country’s history. Echoing the urgency of the situation, Federal Reserve Chair Jerome Powell has emphasized the need for prompt action by elected officials to address the burgeoning debt, underscoring the critical nature of the fiscal challenge ahead.

The recent escalations along the Russia-Ukraine border have intensified the conflict, with both nations engaging in military strikes against each other’s border regions. On Sunday, the northeastern Ukrainian region of Kharkiv and the adjacent Russian region of Belgorod experienced significant attacks. In the aftermath, Kharkiv declared Monday a day of mourning to honor the victims of the shelling, which targeted a frequented leisure area and several villages. The assault resulted in the tragic loss of at least 11 civilian lives and left numerous others injured. This surge in violence underscores the deepening humanitarian crisis and the urgent need for de-escalation in the region.

Microsoft’s Build developer conference, set to commence this Tuesday in Seattle, is poised to be a pivotal event for the tech community. The conference is anticipated to unveil Microsoft’s vision for integrating AI capabilities into the Windows operating system, potentially transforming the user experience of personal computing. Furthermore, there is speculation that Qualcomm’s advanced chips will be at the heart of several upcoming Windows-powered devices. This collaboration could herald a new era of computing, combining Qualcomm’s prowess in chip design with Microsoft’s software expertise to create powerful, AI-enhanced PCs for the next generation of technology users.

The United States’ national debt has soared to a staggering $34.5 trillion, marking an increase of approximately $11 trillion since March 2020. This significant rise has sparked widespread discussion among policymakers and financial experts, with a notable Wall Street firm raising concerns about the potential impact of debt-related expenses on the ongoing stock market rally. The Congressional Budget Office (CBO) projects that the ratio of public debt to GDP will reach unprecedented levels, surpassing any previously recorded in the country’s history. Echoing the urgency of the situation, Federal Reserve Chair Jerome Powell has emphasized the need for prompt action by elected officials to address the burgeoning debt, underscoring the critical nature of the fiscal challenge ahead.

Though the Friday market trade was lethargic it remains bullish due to the massive corporate buybacks exceeding all other buy volume. With a light day on the both the earnings and economic calendars another choppy day is likely unless the Fed speakers add to the their hawkish stance.

Trade Wisely,

Doug

Comments are closed.