Ahead fo the U.S. consumer price report Asia-Pacific stock markets showed varied performances, mirroring the overnight advances on Wall Street where the Nasdaq Composite rallied, undeterred by hot inflation figures. Trading floors in South Korea and Hong Kong remained closed in observance of a holiday. Meanwhile, investors digested the details of Australia’s latest annual budget, unveiled late Tuesday. The People’s Bank of China maintained its one-year medium-term lending rate at 2.5%. The mainland’s benchmark CSI 300 index experienced a slight downturn, dropping 0.85% to end the session at 3,626.06.

European stock markets experienced a modest uptick on Wednesday, with investors’ attention turning to the forthcoming inflation data from the U.S. By mid-morning in London, the Stoxx 600, which spans across Europe, had climbed by 0.3%, with the majority of sectors showing positive momentum. The utilities sector saw a 1% gain, contrasting with a 0.8% decline in household goods.

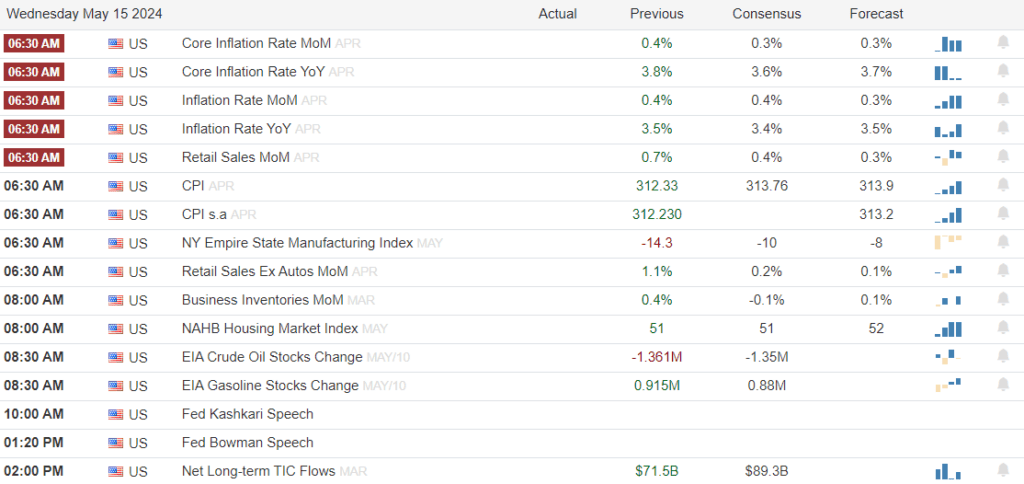

U.S. futures trade with minimal movement as investors anticipate the release of the consumer price index for April. The Dow Jones Industrial Average futures saw a modest increase of 14 points, while the S&P 500 and Nasdaq-100 futures were nearly unchanged. The much-awaited CPI data is expected at 8:30 a.m. Eastern Time. According to forecasts by Dow Jones analysts, the index is likely to reflect a 0.4% rise for the month and a 0.3% uptick when excluding food and energy costs. For the annual headline CPI, a 3.4% increase is projected, slightly down from the 3.5% increase observed in March.

Economic Calendar

Earnings Calendar

Notable reports for Tuesday before the bell include ARCO, DOLE, DT, MNDY, & RSKD. After the bell include CSCO, CPA, GRAB, MAXN, & ZTO.

News & Technicals’

Jamie Dimon, the CEO of JPMorgan Chase, emphasized the importance of the United States addressing its fiscal deficit promptly in a statement on Wednesday. He highlighted the urgency following a series of swift interest rate increases, tax reductions, and substantial stimulus measures implemented to bolster the world’s predominant economy amidst the COVID-19 crisis. “It’s bound to become an issue eventually, so why delay dealing with it?” Dimon questioned during a Sky News interview.

Federal prosecutors have stated that Boeing did not adhere to a 2021 agreement which shielded the company from criminal charges related to two deadly 737 Max accidents. The aerospace giant has been given a deadline of June 13 to present its response to the U.S. Department of Justice. According to the DOJ, Boeing breached the terms of the settlement by not establishing and implementing a robust compliance and ethics framework aimed at identifying and preventing breaches of U.S. fraud statutes.

On Tuesday, Federal Reserve Chairman Jerome Powell emphasized that the decline in inflation is progressing more sluggishly than anticipated, suggesting that high interest rates may persist for a longer duration. Speaking in Amsterdam, Powell remarked, “The path to lower inflation was never anticipated to be without challenges. However, the recent inflation figures have surpassed expectations.” He further indicated that the current situation requires perseverance and a commitment to allowing the stringent monetary policies to take effect. Compounding these concerns, the latest data revealed an unexpected uptick in the producer price index, which climbed by 0.5% in April.

For April, the CPI is anticipated to register a monthly increase of 0.4%, mirroring the rise seen in March, yet the yearly inflation rate is predicted to dip slightly to 3.4%. Excluding volatile items like food and energy, the core CPI is expected to rise by 0.3%, a notch below the 0.4% increase of the previous month, with the annual core rate forecasted to decrease to 3.6% from 3.8%. Analysts on Wall Street will scrutinize the details of Wednesday’s inflation report, seeking indicators of the potential duration of the current high inflation trend. A particular area of interest will be the housing sector’s influence on inflation.

Traders will have a lot of economic data to digest including consumer price report. Plan for considerable price volitility and watch for posible big point whipsaws. With record highs so close a gap though to blue skys is possoble but be cautious of chaising this already extended market condiion for the classsic pop and drop.

Trade Wisely,

Doug

Comments are closed.