The trends remain bullish but since Monday afternoon, the market seems very comfortable with the price level has slipped into a choppy consolidation. With the VIX registering little to no fear and light earnings and economic calendars, we may see much of the same today. News on Brexit could create some volatility. Although the market has largely ignored the impeachment drama, there is the outside possibility of a market reaction once the official vote occurs later today.

Asian markets closed mixed overnight as the monitored Brexit developments. European indexes are trading mixed and cautious on the revived fears of a no Brexit deal. US Futures this morning hover around the flat-line, looking for some inspiration that may not occur until the bigger economic reports scheduled on Thursday and Friday.

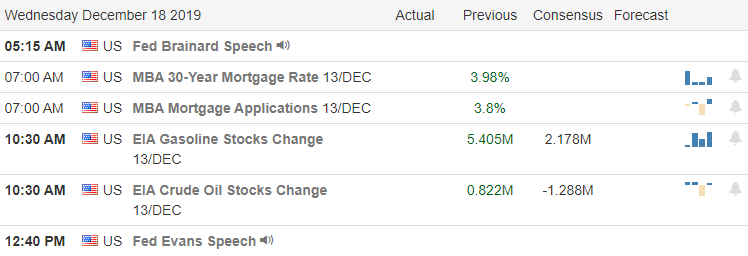

On the Calendar

On the Hump Day Earnings Calendar, we have 15 companies stepping up to quarterly results. Notable reports today include MU, PAYX & GIS.

Action Plan

Today the House is likely to vote to impeach the president with votes falling across party lines. Thus far, the political has been little more than a distraction but we should not rule out the possibility of price reaction after the vote. It may or may not occur but it’s better to prepare than being caught flat-footed in the heat of the moment. Brexit is now back in the news as the Prime Minister risks a No Deal exit from the Euro block by the end of the year. After the bell yesterday, FDX missed on earnings and guided lower as the bad blood with AMZN continues to grow.

With a light day of earnings reports and only the Petroleum Status number to react to on the Economic Calendar bulls and bears my find it difficult to find inspiration. I would not be surprised to see light choppy price action continuing the consolidation that began Monday afternoon. That said, the trends remain bullish, and with the VIX showing little to no fear the bears seem unable to mount much of an attack. In this environment, stocks with momentum can continue to higher or lower but as always keep an eye on support and resistance levels for profit opportunities.

Trade Wisely,

Doug

Comments are closed.