While encouraging to see a second day of gains, not much changed yesterday as the wide-range consolidation continues, unable to break through the upper resistance at the close. However, there seems to be a willingness to ignore the economic data pointing to a contraction of the U.S. economy. Today we get more job data along with international trade and energy figures as FOMC members resume their public conversations. Observe the substantial overhead resistance levels if they beak for a possible short squeeze to be triggered. On the other hand, if it fails to break, prepare for selling to resume pushing back into the consolidation range.

Asian markets saw gains overnight, and the European markets trade mixed as they came to terms with the continued hawkishness of the FOMC. U.S. futures have once again rebounded off overnight lows heading into the open ahead of earnings and potential market-moving economic reports amid some substantial layoff news in the tech sector.

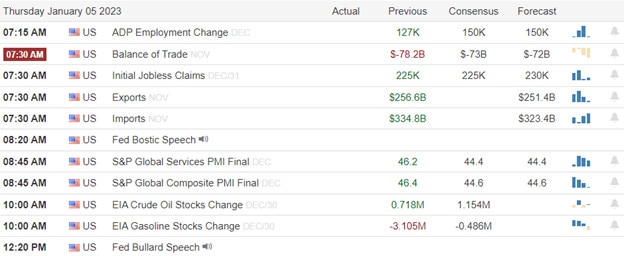

Economic Calendar

Earnings Calendar

We have a bit more activity on the earnings calendar today. Notable reports include ANGO, BBY, CAG, STZ, HELE, LNN, NEOG, SCHN, & WBA.

News & Technicals’

Amazon, one of the largest employers in the U.S., is scaling back more than it had anticipated. Andy Jassy, Amazon’s CEO, said an employee leaked the plans, prompting him to make a public announcement. “Amazon has weathered uncertain and difficult economies in the past, and we will continue to do so,” Jassy wrote in a memo. However, they plan to cut over 18,000 positions from the reported number of 10,000. Salesforce is cutting 10% of its personnel (more than 7000 positions) and reducing some office space as part of a restructuring plan. Co-CEO Marc Benioff told employees that customers had been more “measured” in their buying decisions in the challenging macroeconomic environment. The cloud-based software company let go of hundreds of employees in November. CNBC’s Jim Cramer on Wednesday warned investors that the tech industry would likely see more layoffs due to continuing macroeconomic headwinds.

The U.S. House of Representatives adjourned for the night with no one being elected speaker, paralyzing Congress and deepening the longstanding schisms within the Republican Party. After six votes over two days, GOP leader Kevin McCarthy, R-Calif., failed to secure enough support to win the House speakership. The latest votes saw GOP holdouts nominate and vote for Florida Rep. Byron Donalds.

According to analyst estimates, Samsung’s profit could nosedive nearly 50% when it reports its fourth-quarter earnings guidance. The pessimism stems from a rapid fall in NAND and DRAM memory prices. Samsung is the global leader in memory chips. However, NAND and DRAM prices have fallen sharply in the fourth quarter due to a lack of demand for the products they eventually go into, such as PCs.

While it may have been refreshing to see a second day of gains, the wide-ranging consolidation continues, with the price action unable to breach upper resistance levels by the close of the day. The jobs data continues to roll in such a manner to keep the Fed engaged in continuing to raise rates, and according to the FOMC minutes released yesterday, their willingness to do so seems resolute. In addition, the ISM number indicated that the U.S. economy is still in contraction, adding worry to recessionary thoughts for the year ahead. Today we get more job data along with international trade and energy figures as Fed members resume public comments. Keep a close eye on the consolidation resistance as they continue to pump the premarket, trying to inspire enough buying to break through despite the poor economic numbers.

Trade Wisely,

Doug

Comments are closed.