The price action in Monday’s market showed considerable uncertainty as the SP-500 squeaked above 4000 while the Nasdaq failed to reclaim 3000. I assumed the uncertainty was due to the pending Retail Sales number coming out before the bell today, but the futures seem to project a very bullish result in the pre-market. If correct, it could trigger a substantial short squeeze, but watch for a nasty pop and drop at the open if the number disappoints. Watch those overhead resistance levels and remember Jerome Powell speaks at 2 PM eastern.

Asian markets closed green overnight, led by Hong Kong surging 3.27% as the tech volatility continues. European markets are also in rally mode this morning, with the DAX leading the way, up more than 1.50% this morning. However, ahead of Retail Sales, Industrial Production numbers and comments from the Jerome Powell U.S. futures point to a substantial gap up open. Buckle up the drama is likely to spike the price volatility, so be careful jumping the gun with the fear of missing out!

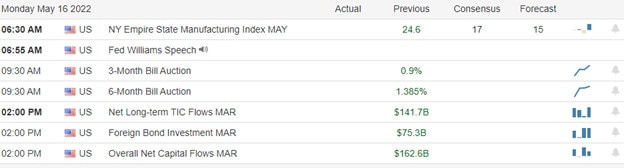

Economic Calendar

Earnings Calendar

We have a lighter day on the earnings calendar with just over 70 companies listed, but many are unconfirmed. Notable reports include WMT, AER, AGYS, TCS, HD, HUYA, JBI, JD, JMIA, KEYS, NXGN, QUIK & SE.

News & Technicals’

Home Depot on Tuesday raised its full-year outlook after reporting strong quarterly earnings, fueled by the company’s strongest first-quarter sales on record. For 2022, Home Depot is expecting sales growth of about 3% and earnings per share growth in the mid-single digits. This marks Ted Decker’s first quarter at the helm of the company. Twitter estimated in a filing earlier this month that fewer than 5% of its monetizable daily active users during the first quarter were bots or spam accounts. But Musk estimates that around 20% of the accounts on Twitter are fake or spam accounts, and he’s concerned that the number could be even higher. “My offer was based on Twitter’s SEC filings being accurate,” Musk tweeted early Tuesday morning. Twitter CEO Parag Agrawal laid out how the social media company fights fake and spam accounts on the platform. The information, posted in a lengthy Twitter thread, comes just days after Elon Musk said on Twitter that he would put his $44 billion acquisition of the company “on hold” while he researches the proportion of fake and spam accounts on the platform. Musk responded to Agrawal’s tweets with a smiling feces emoji. He later added: “So how do advertisers know what they’re getting for their money? This is fundamental to the financial health of Twitter.” Turkey’s Erdogan has doubled down on his opposition to Sweden and Finland joining the NATO alliance, in a move some analysts say is aimed at gaining concessions. NATO’s ascension to a new member state requires consensus approval from all existing members. Turkey, which joined the alliance in 1952, is a crucial player in NATO, boasting the second-largest military in the 30-member group after the United States. Treasury yields rose in early Tuesday trading, with the 10-climbing to 2.92% and the 30-year rising to 3.13%.

Monday’s price action displayed considerable uncertainty as the Dow chopped in a relatively wide range while the Nasdaq struggled to find direction most of the day. However, in the last hour of the day, the SP-500 regained the 4000 by a narrow margin, while the Nasdaq failed to reclaim the 3000 level. The U.S. futures are remarkably happy in the pre-market ahead of Retail Sales numbers after a strong showing from Home Depot raised hope of a robust consumer. Such a move could trigger a short squeeze at the open or a nasty pop and drop if the economic data should disappoint. No matter what happens, keep in mind the downtrend and overhead resistance levels where the feisty bears may set up defenses. With the National Average gas prices hitting another record at $4.52 per gallon and diesel prices at $5.57, consumer spending habits are likely to change.

Trade Wisley,

Doug

Comments are closed.