The choppy relief rally slowly gained strength on Friday, providing a considerable improvement on the technical front as the SPY and QQQ recovered price supports. Of course, we still have overhead resistance levels to deal with, but if the premarket surge holds through the pending economic report, the QQQ is easily within striking distance of new records. The small-cap IWM remains the weakest index, but with oil perking up this morning, look for some modest improvement. That said, the economic data may still put some stumbling blocks in the path forward, so prepare for the wild price volatility to continue.

Asian markets surged off last week’s lows, lead by the NIKKEI up 1.78%, as it recovered from last week’s bearishness. This morning, European markets trade in the green across the board, feeling some sweet relief after the recent selloff. Ahead of earnings and possible market-moving economic data, U.S. futures look to extend Friday’s rally, with the QQQ pushing for a record-breaking breakout.

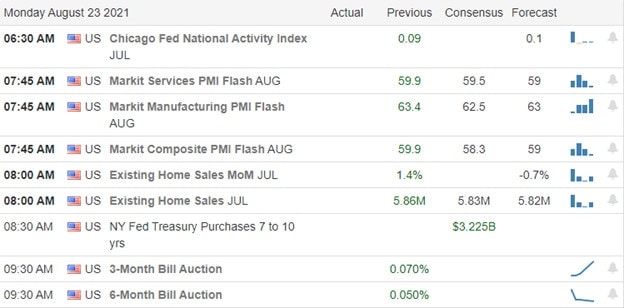

Economic Calendar

Earnings Calendar

We have 25 companies with several unconfirmed expected on the Monday earnings calendar. Notable reports include JD, MSGE, & PANW.

News & Technicals’

As evacuations continue from the Kabul Airport, a firefight broke out between Afghan security and unknown attackers. Once Afghan security personal was killed and three others wounded. Treasury yields begin the week slightly higher this morning, with the 10-year trading up to 1.273% and the 30-year trading at 1.889%.

On Friday, we saw considerable improvement on the technical front, with the SPY and QQQ surging above resistance levels. With futures surging this morning, the DIA will join them as the QQQ stretches toward a possible new record. However, we do have some possible stumbling blocks in this week’s economic reports. Which includes PMI, Durable Goods, GDP, housing data, and even some Fed speak from the chairman. Keep a close eye on the price action as we test record resistance highs, and with earnings reports winding down, it may not be as easy to ignore concerning economic data as we have seen of late. In addition, the sharply lower consumer sentiment may prove to be problematic for market gains if housing and durable goods orders continue to slip or inflationary numbers continue to rise.

Trade Wisely,

Doug

Comments are closed.