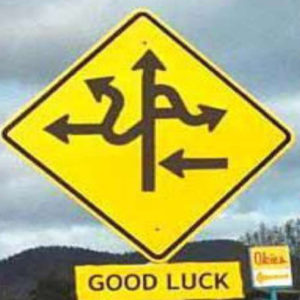

Wednesday was another morning gap, then reversal, as we flip-flop in the frustrating choppy price action on light volume waiting on the Friday CPI. The intraday whipsaws favor experienced day traders and high-frequency firms but only serve’s to chop up the accounts of most retail traders. The indexes have moved hundreds of points over the last few days but ultimately remain stuck in the same trading range. So, I guess we can’t be all that surprised that today is beginning to shape up for more of the same. Perhaps the CPI numbers can give us some direction.

Asian markets were mostly lower overnight as new pandemic rules in Shanghai dampened sentiment. European markets trade in the red this morning as they wait for an ECB decision. However, in another intentionally inspired overnight gap, U.S. futures point to a bullish open to reverse yesterday’s selling ahead of Jobless Claims.

Economic Calendar

Earnings Calendar

The Thursday earnings calendar is pretty light, with less than 20 companies confirmed. However, notable reports include JG, BILI, HOFT, LAKE, NIO, RENT, SIG, SFIX, & MTN.

News & Technicals’

Bosses of major fintech players sounded the alarm about deteriorating macroeconomic conditions at the Money 20/20 Europe trade show. John Collison, the co-founder of online payments firm Stripe, said he was unsure if the company could still justify its $95 billion valuation given the current economic climate. Zopa, a digital bank based in Britain, suggested it was less likely to meet its target of going public by the end of 2022. This week, the Biden administration proposed new standards for its program to build a national network of 500,000 electric vehicle charging stations by 2030. Officials said the proposal would help establish the groundwork for states to build charging station projects accessible to all drivers regardless of the location, EV brand, or charging company. Earlier this year, the White House introduced a plan to allocate $5 billion to states to fund EV chargers during the next five years. On Wednesday, the top U.S. securities regulator, Gary Gensler, proposed rule changes to transform how Wall Street handles retail stock trades after the meme stock mania raised questions last year. The plan would require trading firms to directly compete to execute trades from retail investors to boost competition. In addition, Gensler said the new SEC rules would mandate market makers disclose more data around the fees these firms earn and the timing of trades for the benefit of investors. The Quad countries want to jointly monitor the movements of ships and submarines in the Indo-Pacific using satellites, a move analysts warn could potentially lead to the region’s militarization. “While the Quad as of now is not a security organization, it has the potential to quickly metamorphose into one,” retired Maj. Gen. Dhruv Katoch of the Indian Army told CNBC. The initiative’s military nature is also underlined by the program being driven by the respective navies of the four participating countries — the U.S., Australia, Japan, and India. The initiative will also track “dark shipping” in the Indo-Pacific. Treasury yields slipped just one basis point in early Thursday trading, with the 10-year at 3.02% and the 30-year at 3.16%.

The trading so far this week has been a morning gap followed quickly by a strong reversal, then choppy price action on weak volume. Though we have moved hundreds of points over the last 3-days, nothing has changed as the indexes remain locked between the highs and lows of the range. So, it should be no surprise we have another institutionally inspired gap setting up this morning and likely another day of frustrating chop as we wait on the Friday CPI. Expect volatile price action with a PPI reading next week and a Fed interest rate increase, but perhaps we will have a market direction.

Trade Wisely,

Doug

Comments are closed.