The State Department orders the Chinese Houston consulate to close after charging two Chinese nationals in vaccine hacking attacks against American companies. Beijing, of course, vows retaliation as the tensions continue to grow and adding another layer of uncertainty for the market to deal with as earnings season ramps up. Pressure is also increasing on the economic recovery as the US death toll tops 1100 for the first time since April with the President stating its likely to get worse before getting better.

Asian markets closed the day mixed, but mostly lower and European indexes trade in the bearish territory this morning, reacting to the rising tensions between the US and China. US futures have rallied off overnight lows ahead of Housing Data, and a big round of earning that includes MSFT after the bell today.

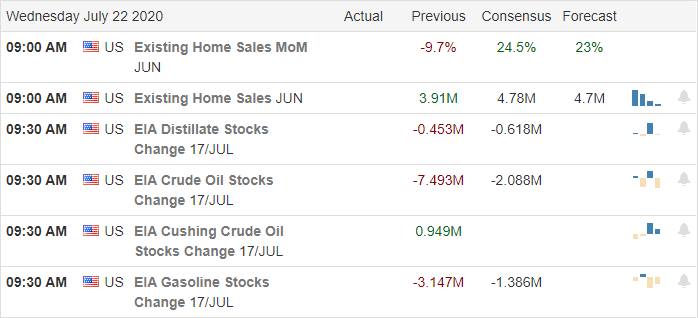

Economic Calendar

Earnings Calendar

On the hump day earnings calendar, we have 47 companies reporting quarterly results. Notable reports include MSFT, TSLA, ABB, ALGN, BKR, BIIB, CP, CMG, CSX, DFS, DOV, EFX, HCA, KEY, KMI, NDAQ, RCI, SLG, SAVE, UAL, & WHR.

News & Technical’s

With tensions growing between the US and China, the State Dept. orders China to close the Houston consulate as Beijing vows retaliation. The decision come after the US charges two Chinese nationals in vaccine hacking attacks. The President, in his first coronavirus briefing in several weeks, said we should expect the pandemic to get worse before it gets better and encourages Americans to wear masks to help prevent the spread. The briefing came on the heels of the largest daily death toll spike since April topping 1100. United Airlines posts a 1.5 billion dollar loss in pandemic impacts that sadly continue to grow daily. During the night, the Alaska Peninsula experience a powerful 7.8 earthquake. Worries of a possible tsunami sent residents fleeing to higher ground, but that threat has now passed. Gold is soaring this morning after Europe delivers another 2 trillion in virus stimulus. Here in the US, Congress continues to haggle over their next stimulus package that may happen as soon as next week.

Yesterday’s gap up open tested but ultimately failed the breach of the resistance of the Island reversal pattern created in early June price action. However, the SPY not only breached the resistance but yesterday broke above its island pattern and, although found some profit-taking by the end of the day, managed to hold onto the new level as support. After attempting a push to new record highs, the QQQ seemed to run out steam leaving behind a contradictory dark cloud pattern while still in a bullish trend. In an interesting turn of events, IWM finished the day strong with the aid of a financial rally. With tensions rising with China, futures were a bit bearish during the night, but as is the norm lately, the morning pump has begun ahead of housing numbers and a big wave of earnings reports. Expect price volatility to remain high.

Trade Wisely,

Doug

Comments are closed.