The Pelosi visit made for a choppy price action day as China’s threats become more aggressive and worries about what their retaliation might mean for the markets and future relations with the country. However, though earnings results remain mixed, the bulls found enough inspiration to keep the relief rally intact with no technical damage in the index charts. The next challenge is the resistance of the long-term downtrend and significant price resistance levels above. With the next two days chocked full earnings reports, the battle at resistance is likely to create substantial price volatility, so plan carefully.

While we slept, Asian markets traded mixed, watching the development of the Pelosi visit to Taiwan closely. European markets also trade mixed with the U.K. expected to raise rates to combat the 40-year high 9.4% inflation rate. However, the premaket pump is underway in the U.S., fueled by the hope of two huge days of earnings reports. So, who wins the battle at price resistance? The next couple of days could tell the tale!

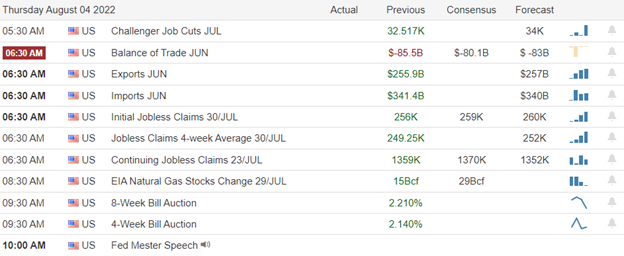

Economic Calendar

Earnings Calendar

More than 300 companies are listed on the earnings calendar for Wednesday though some are not confirmed. Notable reports include ABC, ALGT, ALL, BKNG, BRMN, BWA, CARS, CIVI, CLX, CVS, ELF, FATE, FSLY, FTNT, FUN, GDDY, GNK, GNRC, TWNK, HOOD, HST, MCK, MELI, MET, MGM, MRNA, MRO, MBI, MNST, NYT, NVAX, O, PACB, PDCE, QRVO, RGR, RUN, SSTS, STOR, UAA, WU, & YUM.

News & Technicals’

Pelosi’s visit to Taiwan makes her the highest-ranking U.S. official to visit Taiwan in 25 years, drawing the ire of China, which has called the move a breach of the one-China policy and interference in China’s internal affairs. However, Tsai said she was committed to working with the U.S. over security in the Taiwan straits and the wider Indo-Pacific region and vowed to deepen economic cooperation and supply chain resilience with the U.S. Tsai thanked U.S. House Speaker Nancy Pelosi for her support of democratic values. The Fed has a good chance of not tanking the economy and achieving a soft landing, St. Louis Fed President James Bullard said. Markets lately have been making the opposite bet, namely that a hawkish Fed will hike rates so much that an economy will fall into a recession. The Bank of England is expected to rise by 50 basis points, the largest increase in 27 years. Inflation hit a 40-year high of 9.4%, deepening a historical cost of cost-of-living crisis. Some of the 1.7 million Celsius customers ensnared by the alleged fraud are now directly pleading with the Southern District of New York to help them get their money back. It is the latest sign that the bankruptcy court has become the de facto arbiter of crypto policy in the U.S. Treasury yields dipped in early Wednesday trading, with the 2-year at 3.09%, the 5-year at 2.88%, the 10-year at 2.78% and the 30-year at 3.03%. Keep an eye on the 12-month bonds at 3.06%, which now show an inversion over the two, five, ten, and thirty-year bonds.

Concerns over China’s threats and potential reaction to the Pelosi visit to Taiwan made for a choppy day that had lost some ground by the close. However, the mixed earnings results helped the bulls hold on, producing no technical damage to the relief rally trend. Nevertheless, with the four major indexes challenging the longer-term downtrend and price action overhead resistance, the massive number of reports today and tomorrow could tell the tale. Will it inspire the bulls to break through, or will the bears be inspired to defend resistance levels? The T2122 indicator caught a little break yesterday but remains overbought as the bulls and bears prepare to battle at resistance. Expect price volatility to continue, and keep an eye out for the potential China retaliation and what it might mean for the markets and our future relations with the country.

Trade Wisley,

Doug

Comments are closed.