Traders should fasten their seat-belts tightly because it looks as if the road ahead may continue to be challenging to navigate. With the radical price swings, trading risks are extraordinarily high so consider your decision carefully should you choose to risk your hard-earned money in a market where it is near to impossible to maintain an edge. Very experienced day-traders have the upper hand, while swing and position traders have a substantial risk of intra-day whipsaws and complete overnight rehearsals.

Asian markets closed the day mixed but mostly lower overnight. European markets are modestly bearish this morning ahead of an ECB meeting, and the US futures currently point to a bearish open ahead of earnings and economic reports.

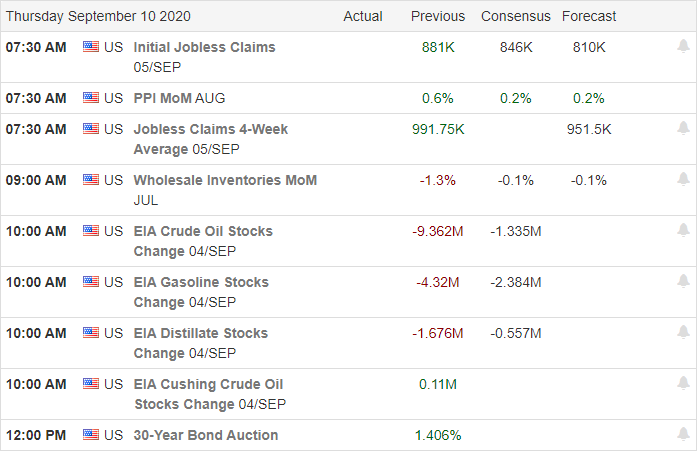

Economic Calendar

Earnings Calendar

On the Thursday earnings calendar, we have 22 companies reporting quarterly results. Notable reports include CHWY, PTON, PLAY, ORCL, & ZUMZ.

News & Technical’s

The wild price action volitility continued yesterday will a big relief rally, but the big question is can it hold. After rising more than 680 points, the Dow dropped more than 200 points in just 30 minutes, heading into the close. The VIX pulled back nicely but ended the day holding at its 200-day average and remaining elevated at the finish, pointing to the significant danger these big price swings create. What comes next is anyone’s guess, so use caution avoiding overtrading because retail traders have little to no edge with such an uncertain condition.

In the index charts, there continues to be no significant technical damage; however, the threat that DIA and SPY may yet test their 50-day moving averages does still exist. Although a light day on the earnings calendar, we do have several notable reports as well as an economic calendar that includes Jobless Claims, PPI before the bell for the market to digest before the open. Currently, futures point to a bearish open, but a lot could change over the next 2 hours with volatility so high. Buckle up the road ahead is likely to remain bumpy and very challenging to navigate.

Trade Wisely,

Doug

Comments are closed.